The US Department of Commerce (DOC) recently announced an investigation into Southeast Asian circumvention of antidumping and countervailing duties. The investigation into whether some countries are bypassing tariffs required by the US was requested by Auxin Solar, a California-based PV module manufacturer. It was opposed by many solar organizations and associations and the DOC’s decision to investigate has sent the solar industry scrambling to respond.

The uncertainty raised by this announcement has already had a far-reaching impact on solar businesses and professionals. Shipments of PV modules have been canceled or delayed, pending the outcome of the investigation, in a market where modules have already become increasingly difficult to source. Even though none of us are strangers to twists and turns in the solar industry, this is a particularly stressful time for anyone in solar.

Unfortunately this is all happening at a time when solar supply chains are already facing unprecedented strain, even as the consequences of climate change are at the forefront of current events. You might call it the perfect storm.

What are antidumping and countervailing duties?

Antidumping and Countervailing duties (AD/CVD) are applied when imported merchandise has been sold in the US at an unfairly low or subsidized price. The duties, or fees, are intended to level the playing field for US companies injured by these unfair trade practices.1

Antidumping investigation

The gist of the situation is this: the US has imposed antidumping and countervailing duties on imported PV solar modules that include Chinese-made solar cells since 2012. A US-based solar manufacturer has alleged that Chinese solar manufacturers are avoiding these duties by filtering their products through cell and module manufacturing facilities in Vietnam, Cambodia, Malaysia, and Thailand.

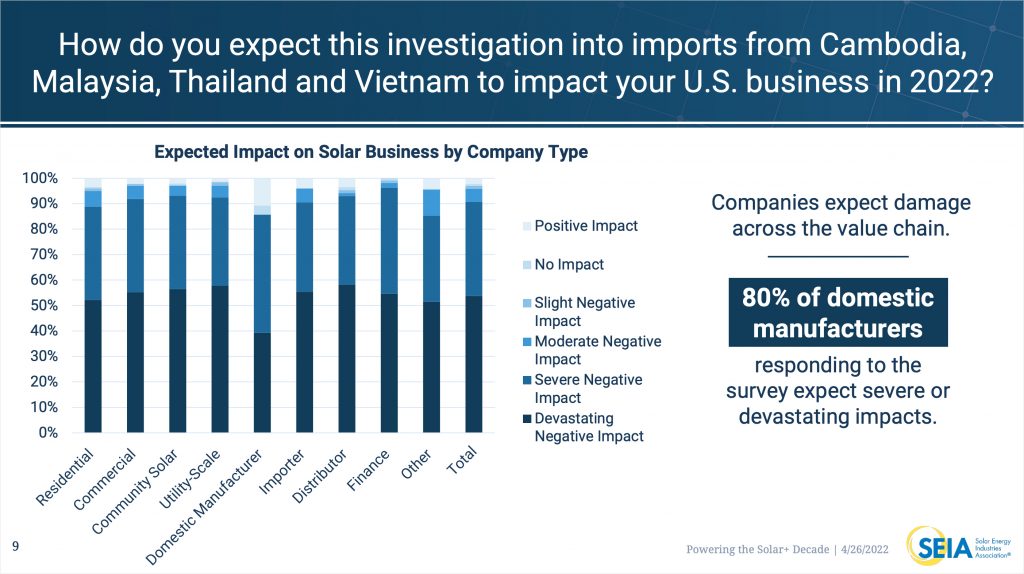

Eighty percent (80%) of US solar manufacturers expect severe or devastating impacts as a result of this investigation.

Courtesy of SEIA, Impact of the Auxin Solar Tariff Petition (April 26, 2022). View full results here.

Even though the complaint was filed by a US manufacturer, the vast majority of solar businesses – including other US-based manufacturers – say they expect the investigation to have a moderate to devastating negative impact on their business. Solar industry organizations are asking for the investigation to be called off or expedited to minimize the damage already happening in both the solar and storage industries. Shipments of PV modules from these Southeast Asian countries have all but ceased, drastically reducing current supply. Predictably, developers are responding by delaying or canceling projects while the investigation unfolds.

Timeline of the AD/CVD investigation

Two likely paths to resolution

The investigation will move forward as presently planned unless the Biden administration (outside the DOC) intervenes to call off the investigation or expedite the timeline.

Path A: Investigation moves forward as presently constituted

If the investigation moves forward in its current form, a Wood Mackenzie report estimates 16GW of panels could be eliminated from the US supply chain.20 About 20 GW were installed in all of 2021 and to meet the Biden administration’s own climate change goals, the US needs to install 60 GW of solar every year from 2025-2035.21 The investigation would clearly jeopardize these goals. From a labor perspective, SEIA estimates the solar industry will lose 70,000 of its 231,000 jobs as a result of the investigation.22

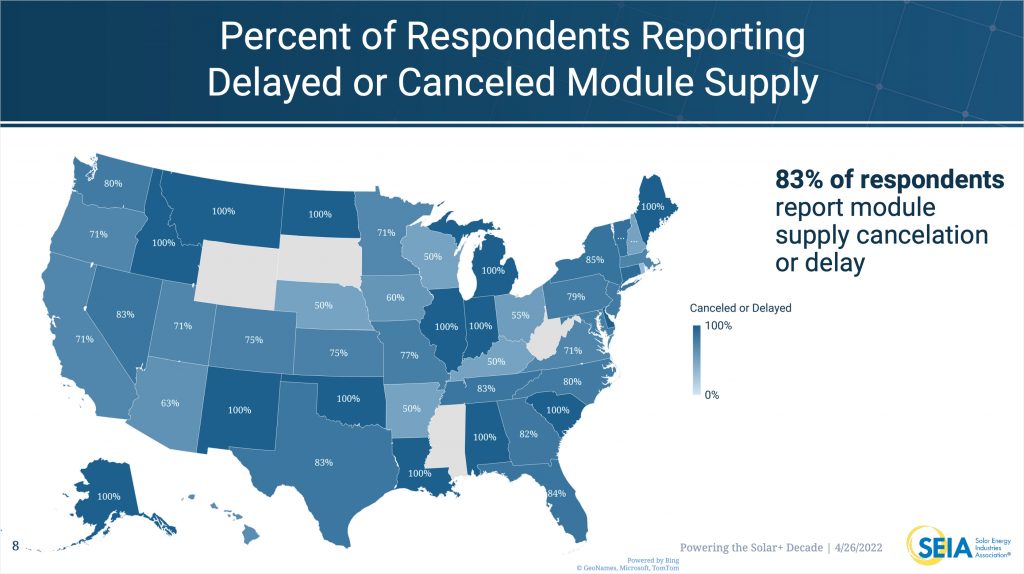

This investigation is already threatening solar project pipelines. Eighty-three percent (83%) of surveyed solar companies report project delays or cancelations.

Courtesy of SEIA, Impact of the Auxin Solar Tariff Petition (April 26, 2022). View full results here.

To be clear, these brutal projections begin to take effect immediately, regardless of any eventual findings of the investigation. Because fees can be applied retroactively, there’s now huge risk involved in selling products from the countries being investigated. Sellers could potentially be on the hook for tariffs as high as 240 percent on previously sold modules.23 Unfortunately for solar distributors and installers, there simply aren’t enough PV modules being produced in the US to fill in the gap – PV modules and cells from Southeast Asia account for 75 to 80 percent of solar modules used in the US (even domestic manufacturers import cells from the countries in question, so their production is also suffering).24

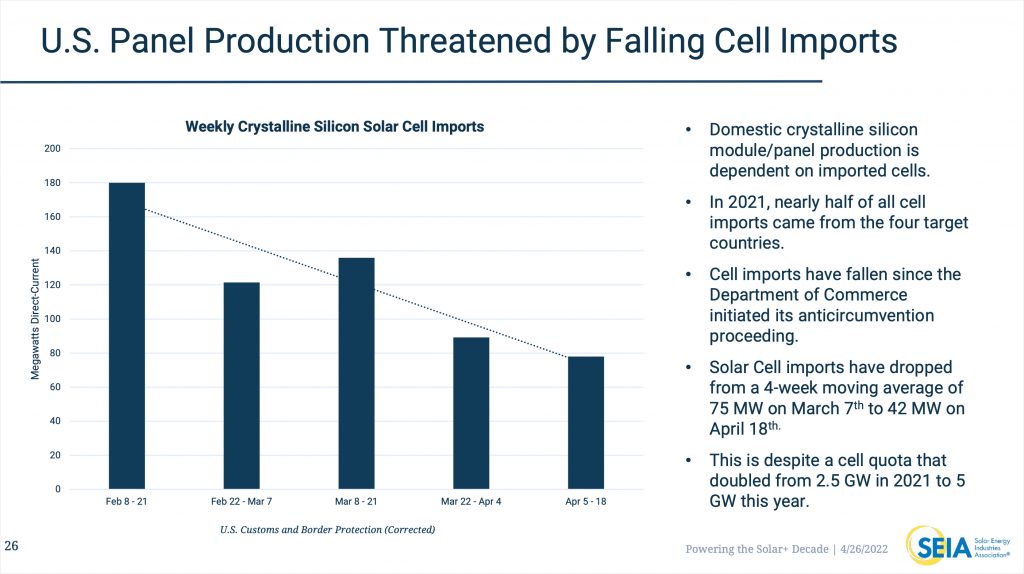

Imports of solar cells – a crucial component in domestically manufactured solar panels – have declined steeply as a result of this investigation.

Courtesy of SEIA, Impact of the Auxin Solar Tariff Petition (April 26, 2022). View full results here.

Though no timeline has been released, an investigation is expected to take somewhere around a year to resolve. The DOC will look at data from supplier facilities, including financial records and material sourcing, to determine whether parts are coming from China, as alleged by the complaint.25 Investigators will also decide whether Southeast Asian cell and module manufacturing facilities are “minor and insignificant contributions to the solar module” as asserted by the petition. Experts in the solar industry say the facilities in these countries represent millions of dollars of capital investment and employ skilled workers, making it unlikely that the investigation will find in favor of the petitioners.26 Still, an ongoing investigation will continue to destabilize the solar industry due to dramatically restricted inventory.

Path B: Biden administration changes the terms

If, as industry organizations are asking, the Biden administration moves to either call off or change the terms of the investigation, the solar supply chain will begin to recover. Sales from Southeast Asia are likely to resume, with a large backlog, though the many separate transport and supply issues that are affecting the industry will likely continue. Fuel costs due to the war in Ukraine combined with mandatory shutdowns in Chinese manufacturing and shipping may not change anytime soon. In short, damage has already been done from many fronts, but it’s not too late to prevent catastrophic outcomes to solar businesses and the industry as a whole if we can get the Southeast Asian supply chain functioning as usual as quickly as possible.

If the investigation is called off, there are certainly ways to address concerns around trade violations as an industry without inviting tariffs that will ultimately harm rather than help US solar businesses. Government can continue to incentivize domestic production in an effort to boost US businesses and increase PV production capacity.

What this means for solar in 2022 and beyond

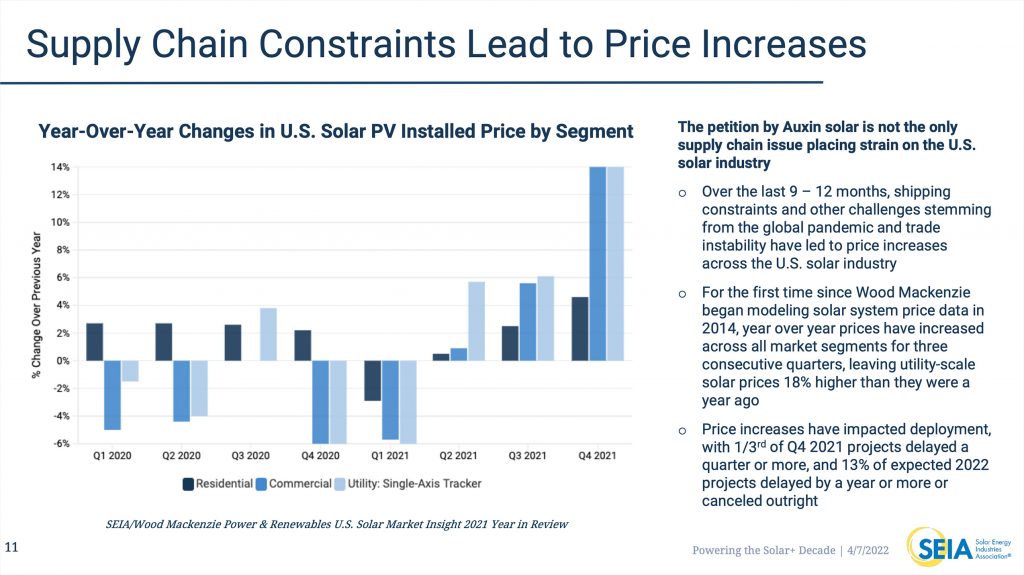

Though we often talk about the “solar coaster,” meaning this industry is notoriously unpredictable, the impacts of the DOC’s investigation combined with the other war and pandemic-driven supply chain issues are really quite unprecedented. One constant in the solar industry has been year-over-year price decreases as technology has improved and solar production has increased. However, the COVID-19 pandemic created supply and logistics bottlenecks that resulted in price increases and just as these conditions began to ease, the war in Ukraine and new lockdowns in China have created new supply chain constraints.

Recent global supply chain challenges have already caused US solar prices to rise for the first time in nearly a decade. This investigation will likely drive prices even higher.

Courtesy of SEIA, Impact of the Auxin Solar Tariff Petition (April 7, 2022). View full results here.

The DOC investigation is expected to dramatically widen the gap between solar demand and supply in the US in 2022, with it potentially taking years for supply to catch back up. The longer the investigation drags on, the longer the industry recovery will take. This is especially disheartening in an industry that has long been on a path of explosive growth.

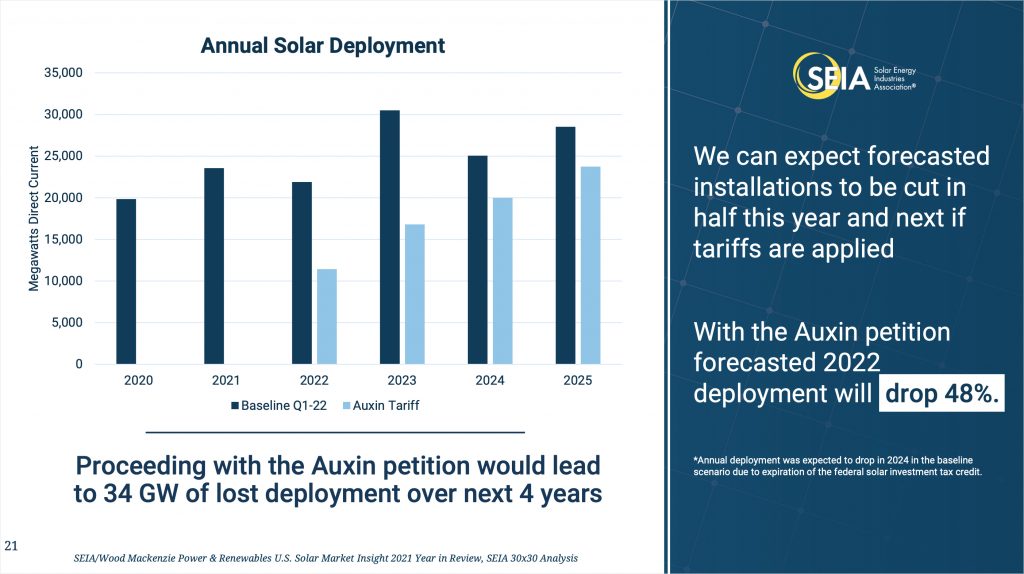

If applied, tariffs will have a tremendous chilling effect on solar deployments over the next several years.

Courtesy of SEIA, Impact of the Auxin Solar Tariff Petition (April 26, 2022). View full results here.

Kinect Solar’s take on the investigation

We are big supporters of US-based solar manufacturing. A major part of the work we do is helping domestic companies run their solar businesses more effectively – by improving logistics and procurement or providing effective routes to market for their products. So we’re certainly not opposed to measures that support domestic manufacturing! We’re also big supporters of getting as many solar projects online as possible and we recognize that relying only on domestic supply in the short term isn’t possible. The capacity simply doesn’t exist yet in the US.

It can take years for solar manufacturing plants to be approved and constructed. If we’re going to meet the current administration’s climate change goals, and if we’re going to continue to see robust job growth in the solar sector, we can’t wait years for new plants to come online.

I believe there is a scenario in which we can ramp up domestic solar manufacturing as part of a long-term strategy to secure our country’s energy independence without crippling the entire industry. This is not the way.

Lauren Carson

, CEO, Kinect Solar

Given that the very purpose of antidumping and countervailing tariffs is to protect US businesses, it absolutely does not make sense to move forward with an investigation that will instead dramatically damage US solar companies. To address trade concerns, Kinect Solar supports an industry-driven approach that includes building domestic manufacturing capacity while also meeting the current demand for solar through the existing international supply.

How you can get involved

If your business has been or will be harmed by the DOC’s investigation, please join us in taking action to promote a better path forward. Solar companies can help by participating in SEIA’s survey, which asks questions about potential business impacts. Solar companies with projects over 1 MW can submit project-specific impact data, which SEIA says is especially helpful in building a case for the DOC to change tactics. Find the survey here: https://www.seia.org/auxin-solar-tariff-petition-impact-survey

How Kinect Solar can help in the interim

In the meantime, we know many solar projects are in limbo and your business may be hurting. Fortunately, Kinect Solar is here for exactly these kinds of twists and turns in the solar industry. Our number one goal is to help your business run better and we’re even more committed to that in uncertain times like these.

Kinect Solar is a leading independent wholesaler in the secondary solar market. As solar modules are increasingly tough to find in the current market, our unique buying strategies offer options for our customers to source inventory and keep solar projects moving forward. Check out our current inventory or reach out to one of our account managers directly.

As your business looks to absorb rising inventory costs, we can also help you optimize costs in other areas. Learn more about our services below or reach out to a Kinect Solar expert directly to find out how we can leverage our size and industry experience to get you better pricing and streamline your solar logistics.

- Domestic shipping

- Warehouse storage or temporary on-site storage

- Port services and drayage

- Liquidating excess or legacy equipment

- Selling on consignment

- Solar procurement services

This post will be updated as new information becomes available. Last revised May 24, 2022.

1 https://www.cbp.gov/trade/priority-issues/adcvd

2 https://www.wiley.law/pressrelease-Wiley-Represents-American-Solar-Coalition-in-Filing-Petitions-to-Combat…

3 https://www.bloomberg.com/news/articles/2021-08-24/nextera-asks-u-s-to-deny-request-for-expanded-solar-tariffs

4 https://www.pv-tech.org/us-ad-cvd-decision-delayed-as-commerce-seeks-new-information-a-smacc-identities

5 https://www.pv-tech.org/a-smacc-stresses-ad-cvd-petition-vital-for-us-solar-refuses-to-publicly-reveal-identities

6 https://www.pv-tech.org/us-department-of-commerce-rejects-ad-cvd-anti-circumvention-petition

7 https://www.pv-tech.org/auxin-solar-calls-for-us-investigation-into-tariff-circumvention-by-southeast-asia-based-companies

8 https://pv-magazine-usa.com/2022/03/28/breaking-dept-of-commerce-to-move-forward-with-solar-anticircumvention-investigation

9 https://www.latimes.com/business/story/2022-03-29/commerce-inquiry-imperils-solar-industry-advocates-say

10 https://www.seia.org/research-resources/impact-auxin-solar-tariff-investigation

11 https://www.seia.org/news/tariff-case-cuts-solar-deployment-forecasts-nearly-half-100000-jobs-risk

12 https://www.nytimes.com/2022/04/29/climate/solar-industry-imports.html

13 https://www.eenews.net/articles/meet-the-ceo-at-the-center-of-solars-most-serious-crisis

14 https://thehill.com/policy/energy-environment/3473824-senators-urge-biden-to-wrap-up-solar-power-probe

15 https://www.renewableenergyworld.com/solar/commerce-secretary-200-solar-tariff-exceedingly-unlikely-in-auxin-case

16 https://www.solarpowerworldonline.com/2022/05/commerce-chooses-8-solar-manufacturers-for-deeper-examination-in-ad-cvd…

17 https://www.solarpowerworldonline.com/2022/05/19-bipartisan-governors-ask-commerce-to-speed-solar-panel-investigation

18 https://www.utilitydive.com/news/85-house-members-add-to-senate-calls-for-an-end-to-anti-circumvention-solar/624087

19 https://www.canarymedia.com/articles/solar/bnef-says-auxin-misinterpreted-its-research-in-calling-for-solar-tariffs

20 https://electrek.co/2022/04/05/heres-how-a-new-us-protectionist-move-could-backfire-badly-on-the-us-solar-industry

21 https://dot.la/biden-tariff-america-solar-2657111042.html

22 https://www.seia.org/news/survey-solar-deployment-hammered-meritless-trade-case-us-climate-goals-jeopardy

23 https://www.latimes.com/business/story/2022-03-29/commerce-inquiry-imperils-solar-industry-advocates-say

24,25,26 https://solarbuildermag.com/news/longi-solar-discusses-potential-ramifications-of-the-ad-cvd-petition