The first quarter of 2023 may have had a slow start, but there’s plenty happening in the industry. From factory announcements to congressional debates and bank collapses, catch up on key trends and events from the past few weeks below.

Domestic manufacturing is absolutely booming

Announcements that new solar manufacturing is happening or planned around the United States have come at a rapid-fire rate since the Inflation Reduction Act was passed last August. The past few weeks have been no exception as more companies continue to announce manufacturing facilities around the country, including Invenergy in Ohio and Hounen Solar America in South Carolina. Battery manufacturing is also on the rise as companies chase federal incentives for electric vehicles. So far, 17 new EV battery facilities have been announced.1

We’re watching this domestic supply chain snowball effect with optimism – in the midst of a lot of challenging economic news, this continues to be a welcome bright spot. Here’s some more good news:

An independent US domestic solar supply chain is possible.

A March report from Solar Energy Industries Association (SEIA) concluded the country now has the appropriate policies in place to support the creation of a mostly independent supply chain.2 That’s an unprecedented turnaround for the US manufacturing sector. Bear in mind, it’ll take several months for these new factories to get up and running, but the landscape is already starting to shift.

The solar industry continues to be a strong job creator.

More than 100,000 new jobs were created in the six months after the IRA was passed and a new report says nine million green energy jobs could be created in the next decade.3 SEIA estimates solar PV and storage manufacturing will create 115,000 US jobs by 2030. Announcements already made will account for up to 80,000 of those.4

The White House wants America to invest in clean energy.

On May 9, the White House released its proposed 2024 budget,5 which includes billions of dollars to address climate change and boost climate tech investments. Of that, $181 million is dedicated to decreasing the deployment of new climate technologies and speeding up permitting. Another $75 million is set aside for the Department of Energy to boost the domestic supply chain.6

The proposed budget hasn’t made it through Congress and is likely to get scaled back, but we’re excited to see clean energy and domestic manufacturing featured prominently in the President’s budget priorities.

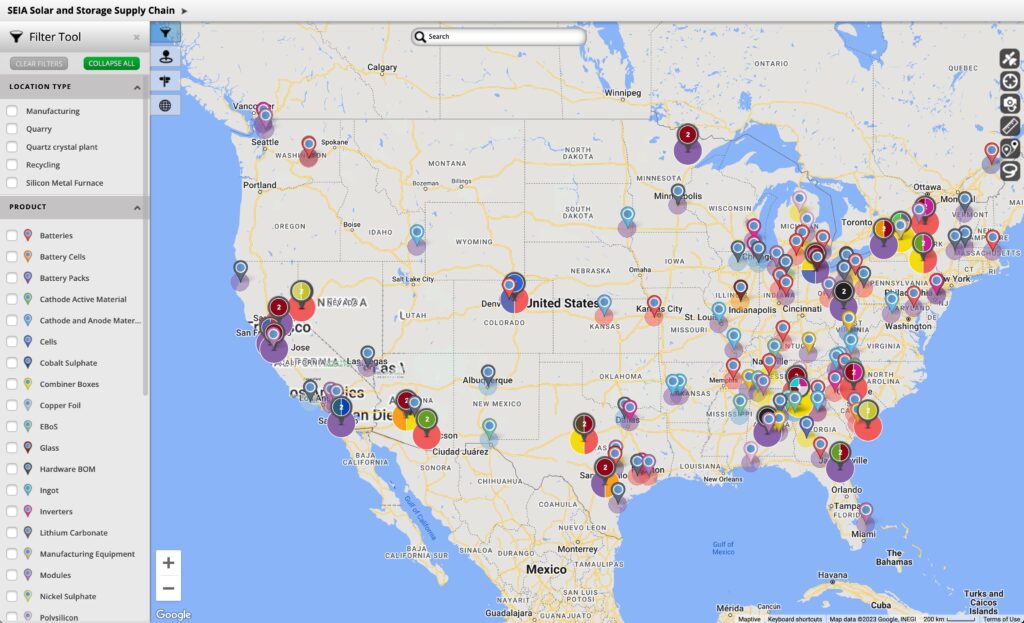

US Supply Chain Interactive Map

Keep tabs on all of the new additions to the US solar supply chain with this incredible dashboard from SEIA. Filter by product type, facility status, and more.

Energy storage is booming too

A new report from US Energy Storage Monitor shows 2022 was a banner year for storage, with 4.8GW of new storage deployed (2020 and 2021 combined saw 5GW).7 Though the pace dipped in Q4, analyst WoodMackenzie predicts ongoing growth, with 75GW coming online between 2023 and 2027.

The inclusion of standalone batteries in the ITC is a game changer, but capturing those credits won’t be easy. Solar developers are staffing up in preparation for managing the complex financial transactions associated with energy credits.8

Solar import tariffs are on the table – again

A year after President Biden announced a two-year moratorium on solar tariffs during the ongoing Anti-Dumping and Countervailing Duties investigation, the matter is again up for debate.10 In spite of strong support from US-based solar companies for the tariff suspension, some lawmakers are calling to reverse the decision through a Congressional Review Act resolution. SEIA estimates some companies could face $1 million in retroactive fines if a change is pushed through congress.11

Supporters of the resolution have framed it as “…standing up for American manufacturers and workers,” and “protecting our domestic supply chain capability” (Rep. Bill Posey, R-Florida)12 since the AD/CVD investigation confirmed some Chinese-based manufacturers were indeed circumventing US tariffs.

Senator Jacky Rosen (D-Nevada), who is leading opposition to the resolution, says it threatens up to 30,000 jobs and US climate goals.13

AD/CVD Determination Forthcoming

The Department of Commerce decided after its preliminary investigation that certain Chinese solar cell and panel producers have in fact avoided US duties. The DOC is expected to release their final determination on May 1, 2023.

In spite of the sunny outlook for medium- and long-term domestic solar manufacturing, the industry continues to rely heavily on imported equipment in the short-term. Abigail Ross Hopper, president and CEO of SEIA said in December, “While President Biden was wise to provide a two-year window before the tariff implementation, that window is quickly closing, and two years is simply not enough time to establish manufacturing supply chains that will meet US solar demand.”

Closing the window sooner than anticipated would create significant strain to the current supply, putting solar projects at risk. There are versions of the resolution being circulated in both the House of Representatives and the Senate. It would have to win a majority vote in both chambers of congress before going to the president’s desk – opponents of the resolution believe that even if it passes in Congress, there is not enough support for it to survive a presidential veto.14

Silicon Valley Bank collapse

Analysts have been scrambling to assess the financial risks to various tech sectors after Silicon Valley Bank, a prominent financier in tech, collapsed mid-March. Initial reports focused on the bank’s self-proclaimed funding of more than 60 percent of US community solar projects – suddenly in jeopardy with the bank’s collapse.

However, Jeff Cramer, CEO of the Coalition for Community Solar Access, says that figure was outdated and funding for community solar is much more diversified today. He anticipates new backing will not be difficult to find, if necessary, because community solar is no longer seen as a risky proposition. “Those will be positive assets on anyone’s balance sheets,” he said.15

General fears within the industry have been eased by the quick announcement that the federal government will guarantee all the bank’s deposits.

Renewable M&As expected to increase

The International Energy Agency expects 2,400GW of renewables to come online through 2027 – as much as the previous two decades combined.16 Such rapid market evolution brings many opportunities for mergers and acquisitions.

According to CohnReznick Capital Markets, “Investors are providing growth capital in the form of a minority stake, often receiving preferred equity in a company that has the potential to grow and expand in the post-IRA world, in which company value could increase substantially over the next few years.”17 CohnReznick expects the current trend of international players acquiring experienced US developers with strong project portfolios to continue.

How we can help

We’re as committed as ever to helping solar professionals navigate the complex solar industry. Connect with one of our solar experts to score low prices on your next order, optimize your logistics arrangements, or plan equipment orders for the upcoming quarters.

1 Robert Walton (February 23, 2023). “Federal incentives help drive $52B of investments in 17 EV battery production facilities: BofA”. UtilityDive

2 Retrieved March 23, 2023. “American Solar & Storage Manufacturing Renaissance: Managing the Transition Away from China”. SEIA

3 Stefan Ellerbeck (March 14, 2023). “Here’s how the Inflation Reduction Act is impacting green job creation”. World Economic Forum

4 Jonathan Touriño Jacobo (March 9, 2023). “IRA to grow US solar and storage manufacturing workforce to 115,000 by 2030 – SEIA”. PVTech

5 Retrieved March 23, 2023. “FACT SHEET: The President’s Budget for Fiscal Year 2024”. The White House

6 Leah Garden (March 27, 2023). “The White House’s 2024 budget proposal prioritizes climate tech”. GreenBiz

7 Andy Colthorpe (March 15, 2022). “US installed almost as much battery storage in 2022 as previous two years combined”. Energy Storage News

8 Andy Colthorpe (March 28, 2022). “US energy storage industry grapples complexity, cost of ITC tax equity transactions”. Energy Storage News

9 Ibid.

10 Kelly Pickerel (March 21, 2023). “Solar panel players still squabbling over AD/CVD circumvention case”. Solar Power World

11 Hans Nichols (March 13, 2023). “Congress braces for flare-up over Biden’s solar panel move”. Axios

12 Ibid.

13 Zack Budryk (March 14, 2023). “Rosen urging Senate Democrats to oppose solar tariff resolution”. The Hill

14 Hans Nichols (March 13, 2023). “Congress braces for flare-up over Biden’s solar panel move”. Axios

15 Jeff St. John (March 14, 2023). “Community solar industry says it can ride out Silicon Valley Bank failure”. Canary Media

16 Ryan Kennedy (March 7, 2023). “Renewables merger and acquisition strategies are shifting”. PV Magazine

17 Ibid.

18 Ibid.

This post is provided for general informational purposes only and does not constitute legal or financial advice. Kinect Solar makes no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of this information. Kinect Solar is not liable or responsible for any damages or losses resulting from or related to your use of this information. This post includes links to websites not affiliated or endorsed by Kinect Solar.