The Inflation Reduction Act sets the solar industry up for a decade of unprecedented growth. In this post, we’ll briefly explain the origins of this groundbreaking legislation, highlight provisions that are sure to impact the solar industry, and discuss some challenges on the road ahead.

JUMP TO SECTION

What is the IRA?

How significant is the IRA?

Which provisions will impact solar most?

What challenges lie ahead?

Kinect Solar can help

President Biden signing the Inflation Reduction Act into law on August 16, 2022 at the White House

Photo courtesy of Doug Mills/The New York Times

What is the IRA?

The Inflation Reduction Act of 2022 (HR 5376 or “the IRA”) is a spending bill signed into law by President Biden on August 16, 2022. The IRA is a trimmed-down version of the Build Back Better bill and is largely regarded as a major win for the Biden administration and the Democratic party ahead of the mid-terms.1

An inflation reduction act may not sound like it has much to do with solar development, but this act is chock-full of solar incentives and funding. The Cliff Notes version is that this legislation was passed through the budget reconciliation process and contains key provisions for reducing government deficit spending (that’s the inflation reduction part). It also contains provisions for expanding clean energy with the goal of reducing greenhouse gas emissions, as well as some healthcare provisions (extending the expanded Affordable Care Act and allowing Medicare to negotiate prescription drug prices).

Passing a bill through budget reconciliation is what ultimately allowed this climate change legislation to pass in the Senate. The IRA is the result of long negotiations and lots of compromise. As a result, it contains measures that environmental advocates don’t like – such as benefits for the oil and gas industry – and it won’t be enough on its own to cut greenhouse gas emissions to the levels agreed upon in the Paris Accords by 2030, or to get the US to net-zero emissions by 2050 (which is critical for halting climate change).2

How significant is the IRA?

This monumental piece of legislation will inject $369 billion into Energy Security and Climate Change programs over the next ten years. The IRA has the potential to be “the biggest climate action ever taken by Congress.”3 And while the IRA isn’t a perfect piece of environmental legislation, it’s a big step for mitigating climate change, putting the US on track to reduce carbon emissions by 40% before 2030. It’s also a massive boon for solar development – the industry is likely to see unprecedented growth in the coming years.

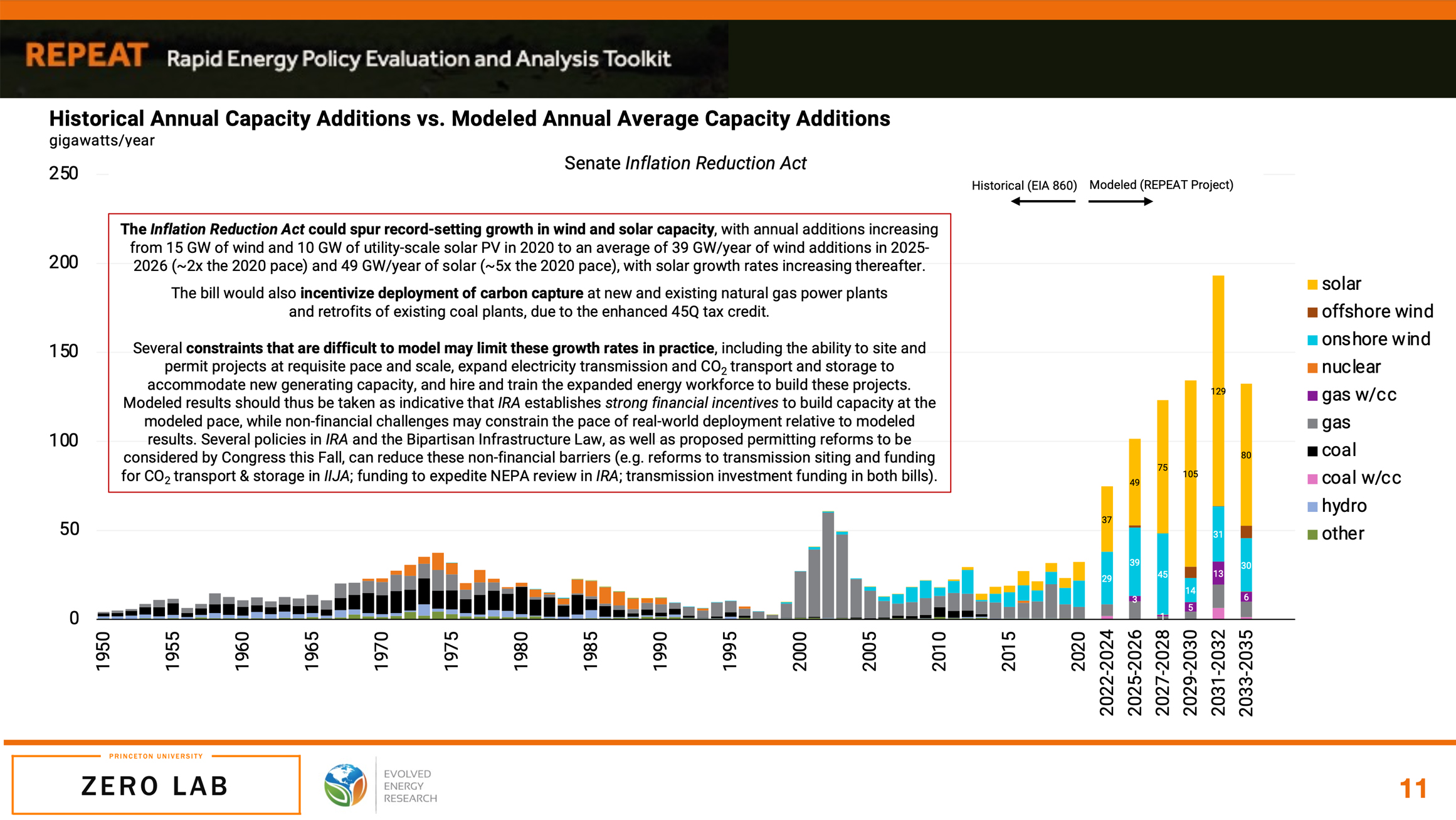

The American Clean Power Association (ACP) projects the IRA will result in the deployment of 550 GWs of clean energy generation in the next decade.5 Abigail Ross Hopper, president and CEO of the Solar Energy Industries Association (SEIA) said the IRA will be a catalyst for reaching the industry’s goal of having solar account for 30% of all US electricity generation by 2030.6 A Princeton study predicts solar adoption rates will reach quintuple 2020 levels by 2025.7

Preliminary Report: The Climate and Energy Impacts of the Inflation Reduction Act of 2022.

Click here to read full study

Which provisions will impact solar most?

There’s a lot in the IRA that doesn’t pertain to clean energy, so to save you some time, here is a rundown of the provisions that are likely to have the most significant impact on the solar industry.

ITC extension

The IRA reinstates the Investment Tax Credit (ITC) for solar at its original rate of 30% and extends it through 2032. The ITC has played a huge role in solar adoption since it was enacted in 2006. The looming expiration of the ITC has been a big piece of the recent uncertainty in the solar market – its 10-year expansion means solar developers and installers can continue to plan for sustained market adoption of solar systems.

More good news: projects completed in 2022 will be eligible for the full 30% credit, which takes the immediate pressure off developers to source solar modules and qualify projects for Safe Harbor – a welcome relief after months of policy uncertainty.

On a broader level, the extension of the ITC signals that the US is committed to solar and ensures that investors continue to look to the clean energy sector as a growth opportunity.

A Brief History of the ITC

Created as part of the Energy Policy Act of 2005, the ITC was introduced as a way to encourage investment in residential and commercial solar energy. So successful has the ITC been at driving solar adoption that Congress has extended it multiple times – in 2006, 2008, 2015, 2020, and now again in 2022. While the provisions of the ITC have changed somewhat with each extension, the 30% tax credit endures as the signature of this important incentive.

According to SEIA, the solar industry in the US has grown 10,000% with the ITC at its back.8

Additional tax credits for power producers

Power producers can now qualify for additional tax credits – up to 50% – for projects that meet the following requirements:9

- 10% by sourcing materials from the US

- 10% for locations historically dependent on fossil fuel jobs

- 20% for small projects in low-income communities

One notable caveat – the IRA also stipulates that to qualify for the base 30% tax credit, projects over 1 MW must pay prevailing wages, otherwise the credit drops to 6%.10

PTC qualification for solar installations

Starting in 2023, solar installations can qualify for the Production Tax Credit (PTC). The PTC was established as part of the Energy Policy Act of 1992 and applied mainly to wind projects. Now under the provisions of the IRA, any electricity source that doesn’t emit carbon dioxide will be able to qualify for either the PTC or the ITC, allowing developers more flexibility to meet their specific needs.11

Direct Pay provision

The IRA adds a Direct Pay provision that will allow developers with little tax liability and organizations that don’t owe taxes to treat the tax credit as a tax overpayment. This will allow those who don’t owe taxes to receive a cash refund for clean energy adoption. In addition to developers with low tax burdens, this includes non-profits, tribal lands, and schools – effectively opening new markets for solarization.12

Photo courtesy of St. Jude Children’s Research Hospital

Tax credits extended to energy storage

Energy storage is about to get a serious boost under the IRA, which extends the 30% tax credit to stand-alone energy storage investments, opening the door for much-needed grid service projects. Previously, energy systems had to be paired with a solar system to qualify. Homeowners must install solar battery systems with at least 3 kWh of capacity to qualify for the tax credit.13

Long seen as one of the missing pieces on our journey toward a more renewable grid, energy storage will finally receive the attention it deserves under the IRA.14

Budget allocated to speed up project permitting

The goal is to fast-track new renewable energy projects by speeding the permitting process. This is great news for solar businesses that can get stuck in limbo waiting for new solar installations to be approved. The bill also calls for comprehensive permitting reform legislation to be passed before the end of the fiscal year.

Incentives for domestic solar manufacturing

More than any bill before it, the IRA pushes for materials sourced and made in the US. The solar industry is already a major job creator and this will add even more jobs to our economy. Ramping up domestic production can also prevent the kinds of supply-chain problems the industry has seen this year from happening in the future.

By incentivizing domestic manufacturing, the IRA will ensure the solar industry continues to be a major player in the US economy. The CEO of Nextracker estimates this bill will add 500,000 new jobs.15

Tax incentives for electric vehicles

New electric vehicles that meet domestic production and pricing requirements will be eligible for a $7,500 tax break, with used electric vehicles qualifying for price-based tax credits.17 Both credits require consumers to meet specified income thresholds.

Tax credits for energy-efficient home improvements

The IRA includes $9 billion in consumer energy rebates for qualified home improvements, including water heater and HVAC system heat pump installations, upgrades to load service panels, wiring repairs, insulation, and the purchase of electric appliances.

What challenges lie ahead?

As we celebrate this development for the clean energy sector at large and the solar industry in particular, we also see some significant hurdles on our path to realizing the full benefit of the IRA.

Supply chain constraints

As eager as businesses and consumers may be to add solar and/or storage under the new incentives, there’s no magic button to fix the ongoing supply chain issues. The pandemic isn’t over, nor is the Russia-Ukraine war. Labor shortages, worker strikes, and record demand are still leading to congestion at the ports, just as the busy shopping season approaches. Interventions implemented by the Department of Transportation have started to ease the situation, but things aren’t much better than they were in 2021. Global shipping leader Maersk doesn’t expect ocean container shipping to normalize until the fourth quarter of this year, for example.18

Given the ten-year reach of the IRA, this might only be a short-term issue, but it will undoubtedly have a dampening effect on things at the start.

Dependence on Asia

The US is far behind Asia, most notably China, in terms of manufacturing capacity. It will take years for new solar module manufacturing capacity to get up and running, even longer for batteries. Until it does, the US solar industry will continue to be highly dependent on Asia for raw materials and manufacturing. It’s still unclear how the Uyghur Forced Labor Prevention Act (UFLPA) will impact imports from China. It’s also unknown how the Anti-dumping Countervailing-Duties investigation will play out in terms of new tariffs (though the IRA goes a long way toward reducing the overall impact any tariffs might have once the two-year waiver expires).

Photo courtesy of Museum of Solar Energy

Labor shortages in clean energy

According to one research firm, the IRA will create 1.5 million jobs by 2030 in construction and installation of equipment (like wind turbines and solar farms), energy efficiency upgrades, transmission, battery storage, and other areas.19 That’s great news for the economy, but finding qualified labor may prove to be difficult. There might not be enough skilled people to fill these jobs in what will likely be a tight labor market (especially as different energy sectors compete for similar talent). Even if there were a large enough pool of potential workers, it takes time and resources to train them. Apprenticeships are hard to come by and trade schools are only starting to integrate clean energy into their curriculum.

Solving this problem will require federal and local government agencies to work with the clean energy industry – which itself is highly fractured – to prepare for that job demand. Historically speaking, progress on that front has been painfully slow.

Transmission upgrades and permitting bottlenecks

This isn’t a new topic to anyone in the industry – our grid needs upgrading. Badly. Unfortunately, the IRA doesn’t go far enough to address this problem. Congress is supposed to pass legislation before the end of the year that speeds up permitting for new transmission lines, but that won’t go far enough.

Sadly, this is a problem that will likely get worse before it gets better as transmission lines strain and crack under the weight of the increased load. It might take a few more Texas-sized grid failures to generate the level of public outrage necessary to force the issue. Let’s hope it doesn’t come to that.

Even with incentives, EVs still out of reach for many

Electric vehicles are too expensive for many consumers, even with tax credits. The IRA doesn’t help much with that. Starting in 2029, electric vehicle manufacturers will find it much more difficult to qualify for tax credits because of new stringent requirements laid out by the IRA. Currently, no vehicles meet those 2029 requirements, which include battery components made 100% in the US.20 A massive overhaul of the electric vehicle supply chain will be required to take full advantage of the IRA. That seems highly unlikely, if not impossible, given the nascent stage of the industry in the US.

More needed to combat climate change

Climate change is a multi-faceted problem and the IRA is far from a standalone fix. We hope to see the momentum generated by the IRA spur additional regulations and incentives to cut greenhouse gas emissions. In the meantime, we’ll take a moment to raise our biodegradable glasses to toast the long journey that brought us here and the promising road ahead.

Kinect Solar is here to help

We’re as excited as you are to get more solar projects up and running in our communities. As always, our number one goal is to make your job easier. From sourcing quality equipment at wholesale prices to optimizing logistics, Kinect Solar offers fully customizable solutions for every-sized solar operation. Take advantage of our solar experts to get your business ready for the pending solar boom:

- Solar procurement services

- Port services and drayage

- Domestic shipping

- Warehouse storage or temporary on-site storage

- Shop our available inventory

1 Cami Mondeaux (August 12, 2022). “Democrats prepare to pass Inflation Reduction Act, securing big win for Biden”. Washington Examiner.

2 Lew Daly (August 5, 2022). “The Inflation Reduction Act: A Climate Down Payment, but Doubts on Environmental Justice”. Roosevelt Institute.

3 Ben King, John Larsen, and Hannah Kolus (July 28, 2022). “A Congressional Climate Breakthrough”. Rhodium Group.

4 Sean Rai-Roche (August 8, 2022). “Inflation Reduction Act passes US Senate, vote in House of Representatives expected this week”. PV Tech.

5 Anne Fischer (August 8, 2022). “US Senate passes Inflation Reduction Act of 2022: An industry reacts”. PV Tech.

6 Anne Fischer (August 8, 2022). “US Senate passes Inflation Reduction Act of 2022: An industry reacts”. PV Tech.

7 Jenkins, J.D., Mayfield, E.N., Farbes, J., Jones, R., Patankar, N., Xu, Q., Schivley, G. (August 5, 2022). “Preliminary Report: The Climate and Energy Impacts of the Inflation Reduction Act of 2022”. REPEAT Project, Princeton, NJ.

8 Retreived August 12, 2022. “Solar Investment Tax Credit (ITC)”. SEIA.

9 Mona Dajani (August 9, 2022). “Diving into the Inflation Reduction Act’s tax credits and the ambitious plan to reshape the US energy sector”. Utility Dive.

10,11,12,13 Jameson C., Vanessa W., Drew Y. (August 10, 2022). “The clean energy provisions of the Inflation Reduction Act of 2022 – a historic effort to encourage the development of clean energy and reduce carbon emissions”. DLA Piper.

14 Jinjoo Lee (August 9, 2022). “Inflation Reduction Act Could Supercharge Grid Energy Storage”. Wall Street Journal.

15 Anne Fischer (August 8, 2022). “US Senate passes Inflation Reduction Act of 2022: An industry reacts”. PV Tech.

16 Sean Rai-Roche (August 8, 2022). “Inflation Reduction Act passes US Senate, vote in House of Representatives expected this week”. PV Tech.

17 Mona Dajani (August 9, 2022). “Diving into the Inflation Reduction Act’s tax credits and the ambitious plan to reshape the US energy sector”. Utility Dive.

18 Jacob Gronholt-Pedersen (August 2, 2022). “Maersk Sees Global Supply Chain Woes for Longer; Lifts 2022 Guidance”. US News.

19 Ben Geman (August 9, 2022). “The coming scramble for clean energy workers”. Axios.

20 Andrew J. Hawkins (August 8, 2022). “No electric vehicles on the market today qualify for the new EV tax credit”. The Verge.

This post is provided for general informational purposes only and does not constitute legal or financial advice. Kinect Solar makes no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of this information. Kinect Solar is not liable or responsible for any damages or losses resulting from or related to your use of this information. This post includes links to websites not affiliated or endorsed by Kinect Solar.