If you’ve been importing solar modules for a while, you may have noticed a recent and potentially confusing shift in standard overseas shipping arrangements with your solar module suppliers toward CIF Incoterms and away from more familiar Incoterms like DDP and FOB. This is causing a lot of confusion for many solar importers. In this post, we’ll explain why this shift is happening and what you can do to navigate this change.

TABLE OF CONTENTS

What are Incoterms?

Choosing the correct Incoterms?

Incoterms commonly used (or misused) in solar

The sudden shift to CIF explained

Tips for using CIF Incoterms as a buyer

How Kinect Solar can help

What are Incoterms?

Let’s begin with some important background information for anyone not already versed in Incoterms and international shipping practices.

Incoterms are rules that are stipulated by the International Chamber of Commerce that define the responsibilities of sellers and buyers in international transactions. The terms are recognized internationally for all foreign cargo shipments and are negotiated between the seller and buyer at the time of sale and included in the sales contract. The designated Incoterms specify which party is responsible for:

- Costs (duties, tariffs, storage, transport, port fees, insurance, etc.)

- Liability (for goods damaged along the way)

- Control (not to be equated with ownership, which is defined separately in the contract of sale)

There are eleven Incoterms, collectively referred to as Incoterms® 2020. Seven Incoterms apply to any method of transport (multimodal) and four Incoterms apply specifically to sea and inland waterways transport:

Multimodal Incoterms

- EXW – Ex Works (insert place of delivery)

- FCA – Free Carrier (insert place of delivery)

- CPT – Carriage Paid To (insert place of destination)

- CIP – Carriage and Insurance Paid To (insert place of destination)

- DAP – Delivered at Place (insert place of destination)

- DPU – Delivered at Place Unloaded (insert place of destination)

- DDP – Delivered Duty Paid (insert place of destination).

Sea and Inland Waterways Incoterms

- FAS – Free Alongside Ship (insert port of loading)

- FOB – Free on Board (insert port of loading)

- CFR – Cost and Freight (insert destination port)

- CIF – Cost Insurance and Freight (insert destination port)

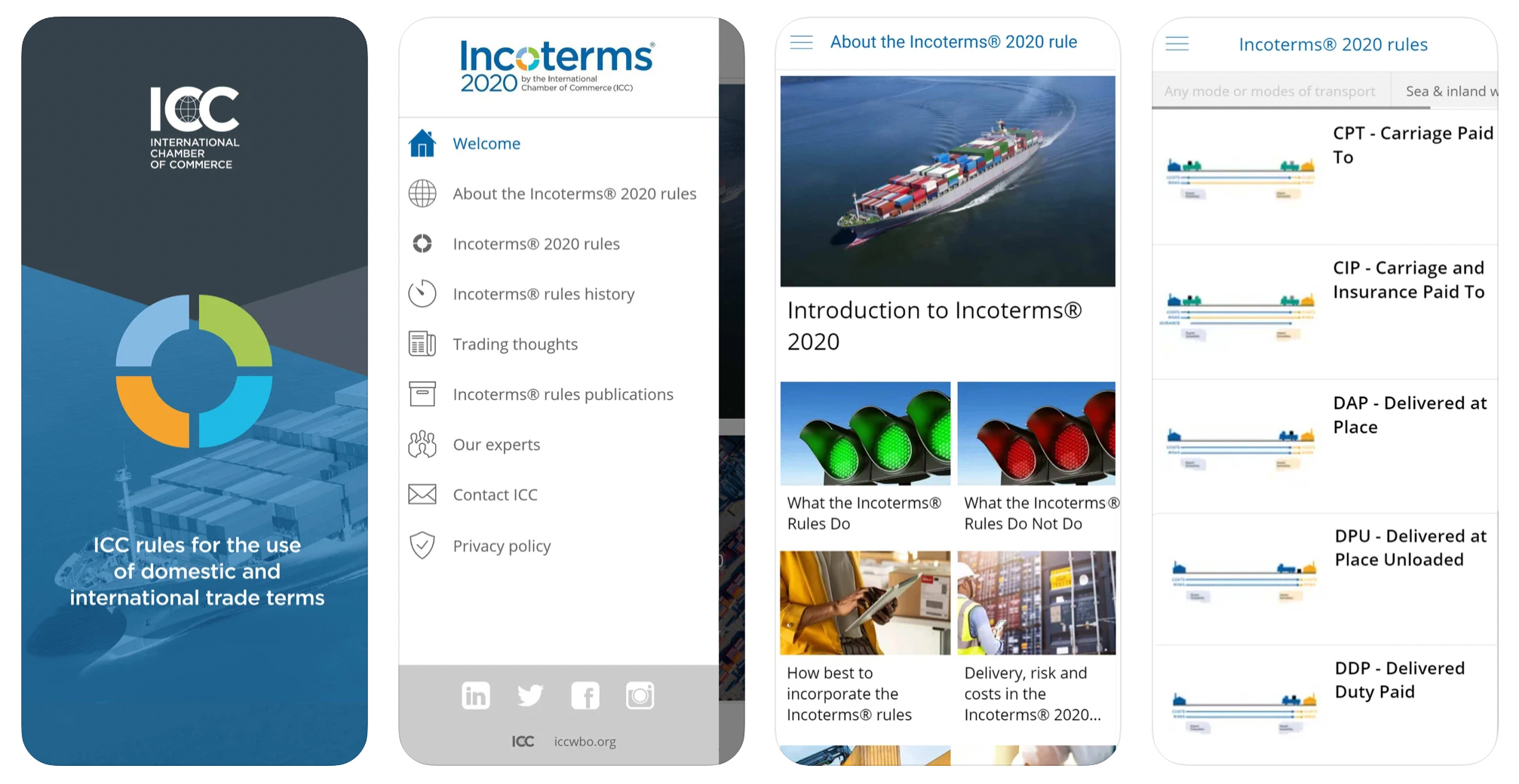

Incoterms are reviewed and updated every ten years. They were last updated in 2020 and are available from the ICC for purchase as an e-book or hardcopy or for free through an app. They also offer a free wall chart if you’re more of a visual person.

Incoterms are incorporated into sales contracts and look something like this (exact language varies widely from contract to contract):

DDP [Specific Location], Incoterms® 2020.

Choosing the correct Incoterms

The Incoterms you agree to as a buyer will directly affect the price you pay for imported modules and the risks you assume along the way. Choosing the wrong Incoterms may lead to contract disputes, delivery delays, payment issues, problems at customs, and other unanticipated costs.

Because of the important role they play, Incoterms are a critical part of negotiating international sales contracts. We recommend you work with a qualified international logistics provider like Kinect Solar, especially if you are new to importing solar modules, to negotiate the best outcomes for you. When used properly, Incoterms can protect your investment and protect you from unnecessary risks.

Incoterms commonly used (or misused) in solar

Despite their long-standing use, Incoterms are still frequently misused in international sales contracts. The solar industry is no exception. The Incoterms we see being used most often for solar module imports aren’t consistent with many of the changes introduced in Incoterms® 2020, especially with regards to containerized goods. With that in mind, these are the Incoterms you are most likely to see when importing solar modules.

Delivery Duty Paid (DDP): Simplest for buyers, maximum responsibility on sellers

Under the DDP Incoterm, the seller is responsible for getting the modules all the way to the buyer’s warehouse or storage location. The seller arranges carriage, ensures the modules are cleared for import, and pays all applicable taxes and duties. The buyer assumes no risk or responsibility until the modules are physically in their possession, aside from providing the seller with any documentation required for export or import procedures. This also means the buyer has no control over the shipping methods chosen (or the costs) and very likely no visibility into the process. If you’re accustomed to purchasing under DDP terms, you’ve likely had little reason to know the details of the international shipping process. Where this is the case, Incoterms with more buyer responsibility will have a bit of a learning curve.

Free On Board (FOB): More control for buyers, requires shipping knowledge

FOB gives the buyer much more control over the shipping terms and costs. Under FOB, the buyer is responsible for arranging shipping and notifying the seller of the arrangements; and the buyer assumes the cost and risks as soon as the modules are loaded onto the carrier. While DDP is undoubtedly simpler, FOB can give you speed and cost advantages once you understand how to optimize carriage and insurance arrangements.

According to Incoterms 2022, FOB is intended for shipping non-containerized sea freight, yet it is still commonly used in international sales contracts for that purpose. See the sidebar for more background on this confusion here in the US. Consider FCA (Free Carrier) as an alternative to FOB when importing solar modules in containers (more on why below in CIF).

Confusion Surrounding FOB

FOB is also used in the US to determine when liability for goods transfers between the seller and buyer in domestic transport, denoted as “FOB origin” or “FOB destination” in the Uniform Commercial Code, which has led to some confusion. The new Incoterms standards released in 2020 are intended to discourage this misuse of FOB internationally.

FOB is also commonly thought to stand for “Freight On Board,” which is not an officially recognized term.

Ex Works (EXW): Only used on rare occasions

EXW places the least responsibility on the seller. Under EXW, the buyer is responsible for collecting the modules from the seller – typically from the seller’s factory – and assumes all responsibilities from that point onward. In our opinion, it’s best to leave EXW in international transactions to experienced logistics experts because of the inherent risks involved to the buyer.

Cost, Insurance, and Freight (CIF): Less risk for sellers, less control for buyers

Under CIF, the buyer assumes the risk as soon as the modules are loaded onto the carrier but the seller arranges for carriage and must insure the modules from the port of origin to the port of destination. The buyer’s responsibilities include custom duties and taxes, inspection fees; and receiving the invoice, insurance policy, and bill of lading. Any tariffs, including new or increased tariffs, are the responsibility of the buyer. If purchasing under this Incoterm, buyers should have a solid understanding of each step of the process to avoid delays or losses.

CIF is distinct from most Incoterms because under its use, the buyer takes on the risk while the seller is still in control of the transport method and insurance. In other words, the seller chooses the freight carriers and insurance stipulations, but if anything goes wrong with the ocean freight containers, the buyer is responsible for sorting it out.

Like FOB, CIF is intended for non-containerized sea freight. Both FOB and CIF call for cargo to be placed on board the vessel by the seller, but that’s not how things work at most modern-day ports. In most cases, sellers turn containers over to a shipping company at a freight station or container depot (which may or may not be located at the port) days prior to loading the vessel. This becomes problematic when the modules inside the containers are damaged at this stage of the journey. Because containers are sealed, these damages are rarely discovered before the containers are opened at their destination, which then makes it difficult to determine the exact cause and timing of those damages.

To avoid that situation, consider CIP (Carriage and Insurance Paid To) as an alternative to CIF when importing solar modules in containers, which also requires the seller to insure the modules while in transit.

The sudden shift to CIF explained

There are a couple of reasons solar module suppliers are requesting or requiring CIF Incoterms more often in today’s import-export climate.

Reason #1: Supply chain costs are significantly higher because of the pandemic.

The cost of transporting goods across global supply chains has skyrocketed because of the Coronavirus pandemic, exacerbated by the war in Ukraine. Diesel prices are at record highs and port fees for detention and demurrage have doubled since the pandemic began. On average, we’ve seen the cost of shipping a container of solar modules jump nearly tenfold between Q1 2019 and Q1 2022. By switching from DDP to CIF, for example, module sellers are able to shift more of those costs to buyers.

Reason #2: The solar investigation is creating uncertainty over tariffs.

Sellers are playing hot potato with buyers over potential tariff increases resulting from the investigation into antidumping and countervailing duties (AD/CVD) in Vietnam, Cambodia, Malaysia, and Thailand. By shifting to CIF, sellers are forcing buyers to accept the risk of tariff increases sooner in the shipping process.

We won’t know if the shift to CIF is a temporary reaction by sellers to these conditions or if it’s part of a long-term trend until after the AD/CVD investigation is over and the market stabilizes. Until then, we are here to help you navigate this change.

Tips for using CIF Incoterms as a buyer

Though CIF is neither the simplest nor the cheapest option for importing solar modules, don’t despair. With a good understanding of the process and some tips under your belt on how to avoid common pitfalls, you can make CIF work for your business. Of course, you can also opt to keep things simple by having Kinect Solar handle all the arrangements for you. We’re here to help at whatever level your business requires.

Tip #1: Don’t believe the CIF sticker price.

The price advertised by the seller on modules shipped CIF often excludes destination terminal handling charges (DTHC) and other fees charged by the seller’s freight forwarder upon arrival. These charges are often inflated. Sellers may also include surcharges on freight costs labeled as “value-added service.” More often than not, these surcharges are a sneaky way for sellers to cushion their bottom line.

Tip #2: Make sure to spell out who is responsible for terminal handling charges.

Building on that last tip, make sure to clearly spell out who is responsible for terminal handling charges. Under CIF, sellers typically cover terminal charges at the origin terminal while the buyers cover terminal charges at the destination terminal. Whatever you and the seller agree to, just make sure you include it in your contract. The last thing buyers or sellers want in this environment is to pay additional demurrage charges.

Tip #3: Insurance coverage is negotiable. You can press for higher coverage.

According to Incoterms 2020, sellers are required to ensure goods for 110% of their contract value when shipping CIF, but the parties may agree on different coverage (remember to include this in your sales contract).

Under CIF rules, the buyer accepts the risk of damages in transit. This means that if something goes wrong, you’ll need to file a claim with the insurance provider selected by the seller. Carefully review the insurance coverage provided by the seller. Once the modules are loaded on the ship, you’ll have to live with the coverage terms of the insurance provider. Consider negotiating for additional coverage, which will help cover unforeseen expenses and the headache of dealing with insurance if your modules get damaged along the way.

Be aware that the seller is not obliged to arrange insurance for pre-carriage in the export country or carriage in the import country unless this is specified elsewhere in the sales contract.

Tip #4: Make sure the seller is NOT listed as the beneficiary on the insurance policy.

Sometimes we run into this issue, where a seller has listed themselves as the beneficiary on the insurance policy. This nearly always leads to a legal battle and added expenses. It’s your responsibility as the buyer to ensure you are listed as the beneficiary. For added peace of mind, spell this out in your sales contract.

Tip #5: Hold the seller accountable for completing the Importer Security Filing (ISF) on schedule. Include a clause in your contract that requires the seller to take responsibility for any penalties if they are at fault.

Buyers are required to provide the ISF filing at least 24 hours before loading the goods on a carrier bound for the US. Goods cannot clear customs without this but it relies on information from the seller. If the filing is late, fines and penalties can be as high as $5,000 per violation.

Tip #6: Know your tariff risks.

The open antidumping/countervailing duties investigation has the potential to result in retroactive tariffs for solar materials shipped from Southeast Asia. Under CIF Incoterms, you as the buyer could be responsible for those charges down the road. Though we hope not to see any retroactive tariffs applied, it’s important for you to understand the financial risk at the time of purchase.

Tip #7: Consider working with a solar logistics expert.

Consider working with a solar logistics expert like Kinect Solar. An experienced logistics provider can help you understand the risks, negotiate on your behalf, and even manage the process for you.

How Kinect Solar can help

If you’re new to importing or your business is accustomed to using DDP, using a new Incoterm will likely require some initial education and significant ongoing management. For businesses without their own logistics capabilities, this can be a strain on resources as well as a cause for project delays. Our solar experts can help you determine the right Incoterm for your business and, where needed, make the logistics transition immediately. We’ll work with you to get the right processes in place, or we can handle all the logistics for you. Every solar business has different needs and expertise – we’re here to fill in the gaps so industry changes don’t slow you down.

Talk to one of our solar experts today to customize a solution for your business, or learn more about our services:

- Domestic shipping

- Warehouse storage or temporary on-site storage

- Port services and drayage

- Liquidating excess or legacy equipment

- Selling on consignment

- Solar procurement services

Incoterms® and the Incoterms® 2020 logo are trademarks of ICC. Use of these trademarks does not imply association with, approval of or sponsorship by ICC unless specifically stated above. The Incoterms® Rules are protected by copyright owned by ICC. Further information on the Incoterms® Rules may be obtained from the ICC website iccwbo.org. The information on this page is provided as a resource to familiarize solar importers with Incoterms®. This page does not constitute legal advice.