Third-party ownership (TPO) is on the rise and gaining momentum in the residential and small commercial markets, reversing a years-long trend away from PPAs and solar leases toward solar loans. In this post, we’ll explore what’s behind this recent shift. For additional context on what’s been happening in the industry this year, check out our first and second quarter 2023 market updates.

Factors driving PPA and lease adoption

Stubborn inflation and high interest rates

According to New York Federal Reserve President John Williams, the US and other major economies are still benefiting from relatively low interest rates, despite the wide-spread financial impact of the COVID-19 pandemic and the inflation surge that followed it. But with credit card rates topping 20% and mortgage rates and auto loans hovering around 6.5%, that might not seem like much of a silver lining.

Even though the installed price per watt of solar has dropped significantly over the past few decades, paying with cash for a new system is still an expensive proposition. For those wanting to own their system outright, solar loans have historically been a smart alternative, especially when interest rates were low.

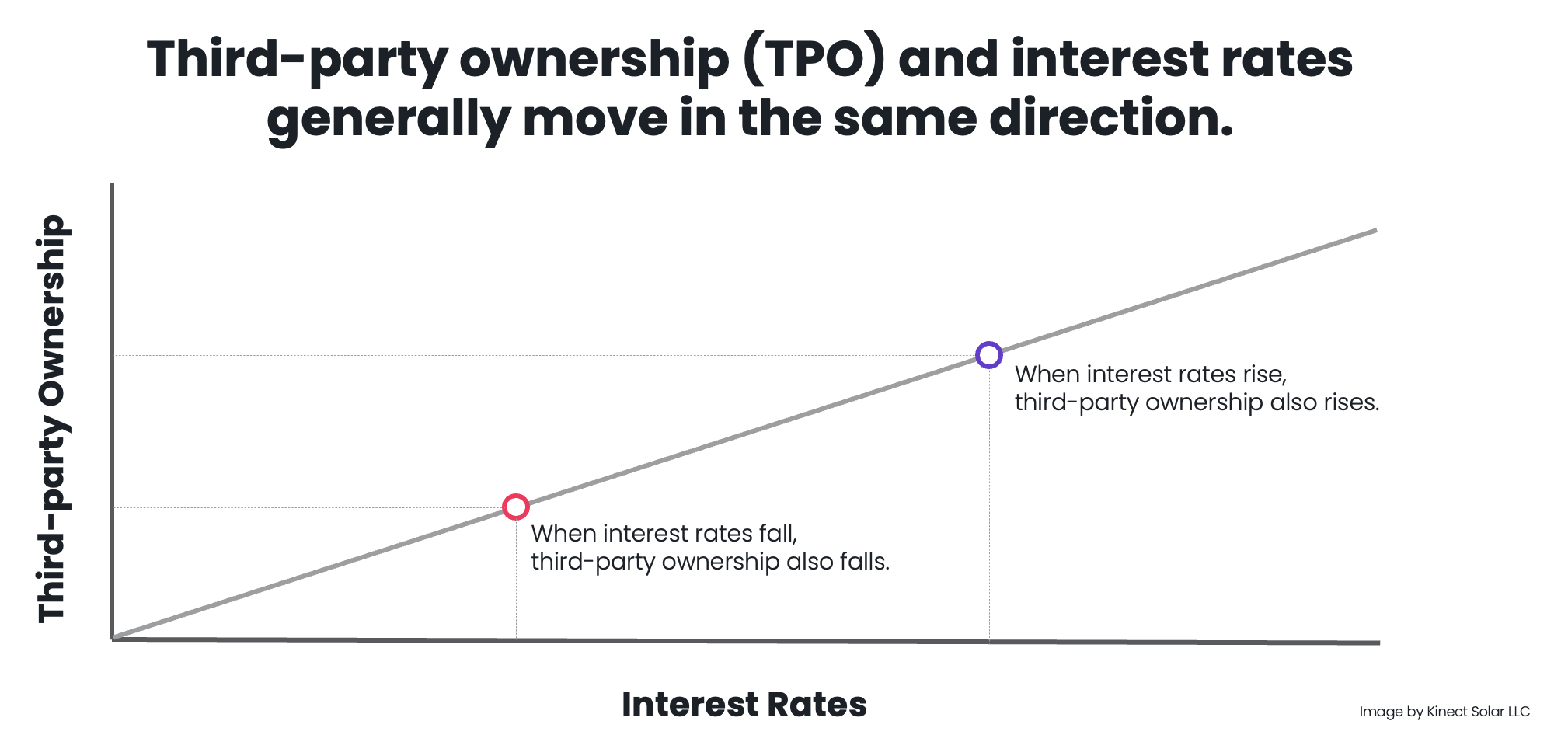

But with interest rates triple what they were a year ago, loans are less attractive. Buyers are turning once again to TPO options in the form of Power Purchase Agreements (PPAs) and solar leases, which together accounted for 72% of the solar market a decade ago but declined to around 30% while interest rates were at all-time lows.

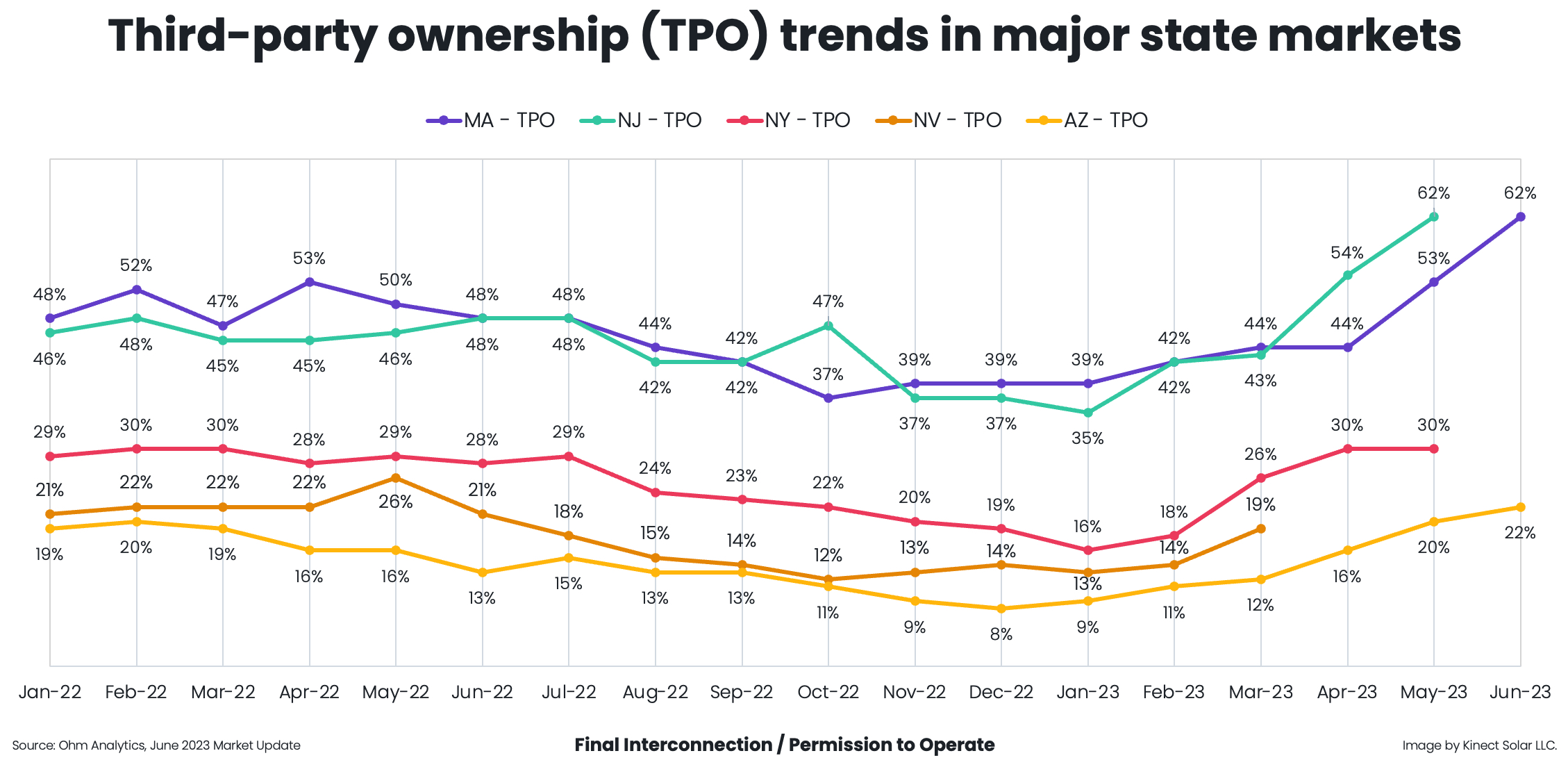

In a 2023 industry survey, 71% of solar installers reported customers were less likely to pursue a solar loan in 2022 than previous years. Recent data from Ohm Analytics shows a notable uptick in TPO adoption in several major markets during the first half of 2023.

Bonus credits in the Inflation Reduction Act (IRA)

Third-party owners may qualify for additional tax credits available through the Inflation Reduction Act, which the IRS recently clarified in May 2023. It is safe to assume that third-party owners will be more aggressive about pushing their TPO-products in the market in order to capitalize on these incentives.

| Tax Credits for Homeowners (2023-2033) | Tax Credits for Third-party Owners (2023-2033) |

|---|---|

| 30% Investment Tax Credit (ITC) | 30% Investment Tax Credit (ITC) |

| 10% Domestic Content Bonus | |

| 10% Energy Community Bonus | |

| + Additional bonuses for projects in LMI communities or on Indian land, or qualified low-income projects |

California NEM 3.0

The California Public Utilities Commission (CPUC) recently rolled out sweeping changes to the state’s net metering policies for customers in the three largest investor-owned utilities. NEM 3.0, as it’s known, is meant to shore up the grid and boost adoption of solar batteries. Highly differentiated time of use (TOU) rate plans reward customers for drawing power from solar batteries instead of the grid during peak evening hours.

While solar storage systems have been coming down in price over the past few years, they are still prohibitively expensive for most customers, especially when purchased concurrently with a solar system. For the majority of Californians, TPO may be the only realistic option. Sunrun is responding by rolling out solar-plus-storage offerings, available through PPA or solar lease.

Industry experts predict battery attachment rates in California will increase from 11% today to more than 80% by 2027 as a result of NEM 3.0, which went into effect on April 15, 2023. TPO adoption in California is likely to follow a similar trajectory.

Source: Utility Dive

What companies offer solar PPAs and leases?

Sunrun is the largest TPO provider and combined with Sunnova captured 77% of the solar TPO market in 2022. Because of the large up-front investment and delayed profits, the PPA/solar lease market is tough to break into, even for large companies. Smaller solar installers can rarely afford to offer PPA and lease products on their own and must partner with one of the larger companies to make these options available to their customers.

Where are solar PPAs allowed?

Not every state allows PPAs, but many do: Arizona, Arkansas, California, Colorado, Connecticut, Washington D.C., Delaware, Hawaii, Illinois, Iowa, Maryland, Massachusetts, Michigan, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, Ohio, Oregon, Pennsylvania, Puerto Rico, Rhode Island, Texas, Utah, Vermont, Virginia, and Washington.

Some of the above states have limits on the type and size of system that is eligible for a PPA and some states not listed specifically ban PPAs: Florida, Georgia, Kentucky, North Carolina, and Oklahoma.

What’s the difference between a PPA and a lease?

Solar PPA: A contract between a customer and a solar installer or developer. The installer or developer is responsible for all aspects of the solar installation: design, permitting, financing, and installation. The customer hosts the installation on their property and purchases the power generated by the solar system from the developer at a fixed rate (per kWh). The rate is typically lower than the local utility rate and the customer saves on their monthly electric costs. The developer receives income from the customer and retains rights to any tax credits or other incentives.

Solar Lease: A third-party installer or developer is responsible for all aspects of the solar installation: design, permitting, financing and installation. The customer hosts the installation on their property and leases the solar system from the developer at a monthly rate, typically lower than their average electric bill. Solar leases typically require a contract of 10-25 years.

| Solar Lease | PPA |

|---|---|

| Typically shorter terms (10-25 years residential; 7-20 years commercial) | Typically longer terms (20-25 years) |

| Flat monthly fee | Monthly charges per kWh used |

The developer retains ownership of the system under both a solar lease and PPA. As the owner of the system, the developer claims any applicable tax credits or other incentives (such as the ITC and bonus credits). This is part of what makes it possible for solar companies like Sunrun to offer TPO options.

Final thoughts on the benefits of PPAs and leases for solar panel adoption and the future of solar energy

Solar PPAs and leases may prove to be a great way for customers to continue to afford new solar installations in the face of inflation and high interest rates. Between multiple financing options (like TPOs), the financial incentives in the IRA, and the growing availability of Green Banks, funding for solar projects should remain accessible, in spite of inflation and rising interest rates. This should allow the industry enough flexibility to bounce back from the financial and supply chain challenges that have plagued it for the past several months.

Sources and further reading:

Fed’s Williams says world of low interest rates still prevails [Reuters]

A new era for U.S. residential solar finance: ITC, loan market headwinds shaking up landscape [Solar Builder Mag]

California’s new net-metering policy brings batteries to forefront [PV Magazine]

Sunrun, others adapt as California’s new net metering rules spur booming interest in energy storage [Utility Dive]

Sunrun Launches Shift, a New Home Solar Offering [Sunrun Press Release]

Federal Solar Tax Credits for Businesses [US DOE]

Will rising interest rates curb the dominance of the US residential solar loan market? [WoodMac]

SolarReviews releases the results of its 2022 Solar Industry Survey [Solar Reviews]

Third-Party Solar Financing [SEIA]

Solar leases vs. solar PPAs [Energy Sage]

This post is provided for general informational purposes only and does not constitute legal or financial advice. Kinect Solar makes no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of this information. Kinect Solar is not liable or responsible for any damages or losses resulting from or related to your use of this information. This post includes links to websites not affiliated with or endorsed by Kinect Solar.