The IRS has released proposed guidance for domestic manufacturing requirements under the Investment Tax Credit (ITC). More guidance is expected to come in August. As expected, the proposed regulations do not please everyone. Reactions range from criticism that the guidelines do not require more domestic manufacturing of PV cells – with some calling for even wafers to be domestically made – to satisfaction with the structure of the regulations. We’re optimistic that the multi-year ramp up to the final domestic content requirements will give the industry time to get planned US-manufacturing facilities into production.

What is the Domestic Content Requirement?

IRS Notice 2023-38 states that solar power projects eligible for the 30 percent ITC may also qualify for an additional 10 percent bonus credit if they satisfy the following requirements:

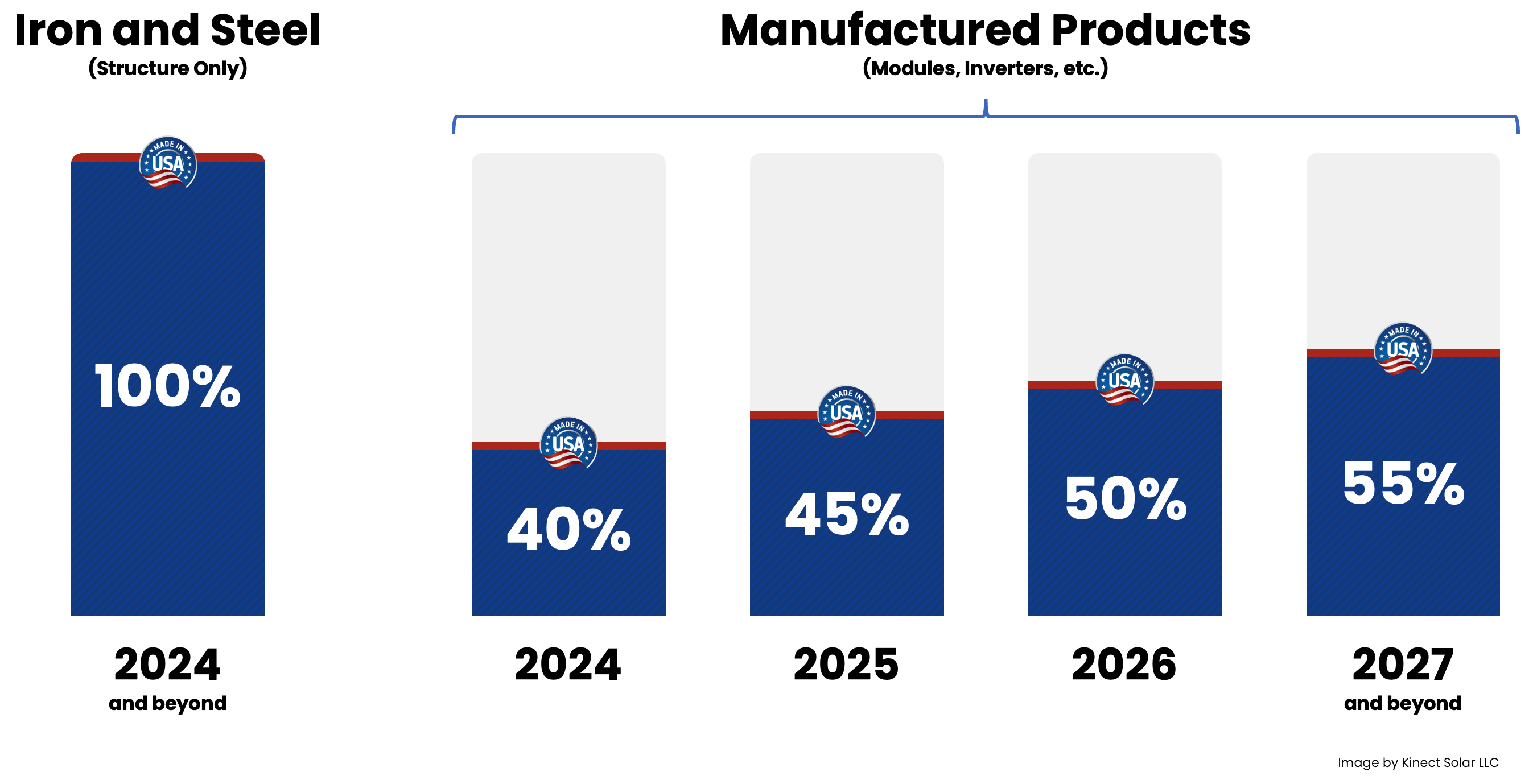

- All of a project’s iron and steel products must be melted and poured domestically. This applies to materials that are structural in nature (not things like nuts and bolts).

- A percentage of the cost of manufactured products (combined) must be mined, manufactured, or produced in the US. That percentage will ramp up over the next three years:

- 40% for projects on which construction starts in 2024

- 45% for projects starting construction in 2025

- 50% for projects starting construction in 2026

- 55% for projects starting construction after 2026

- The project meets any ONE of the following requirements:

- The energy project has a maximum net output of less than 1MW

- Construction of the energy project began before January 29, 2023

- The energy project satisfies the Prevailing Wage and Apprenticeship Requirements

As a reminder, projects over 1MW that began construction after January 29, 2023 must meet the Prevailing Wage Requirements in order to qualify for the full 30% ITC. See our tips for meeting these requirements in this post.

What does the Domestic Content Requirement mean for solar developers?

The Spark Notes version is that solar developers will need to know a lot more about how and where their solar equipment is made. The guidelines are pretty complex (more than we anticipated), but positioning your business to take advantage of both the 30 percent ITC and the 10 percent adder is going to become increasingly important for cost competitiveness. Project developers are responsible for certifying the project’s eligibility for tax credits to the IRS.

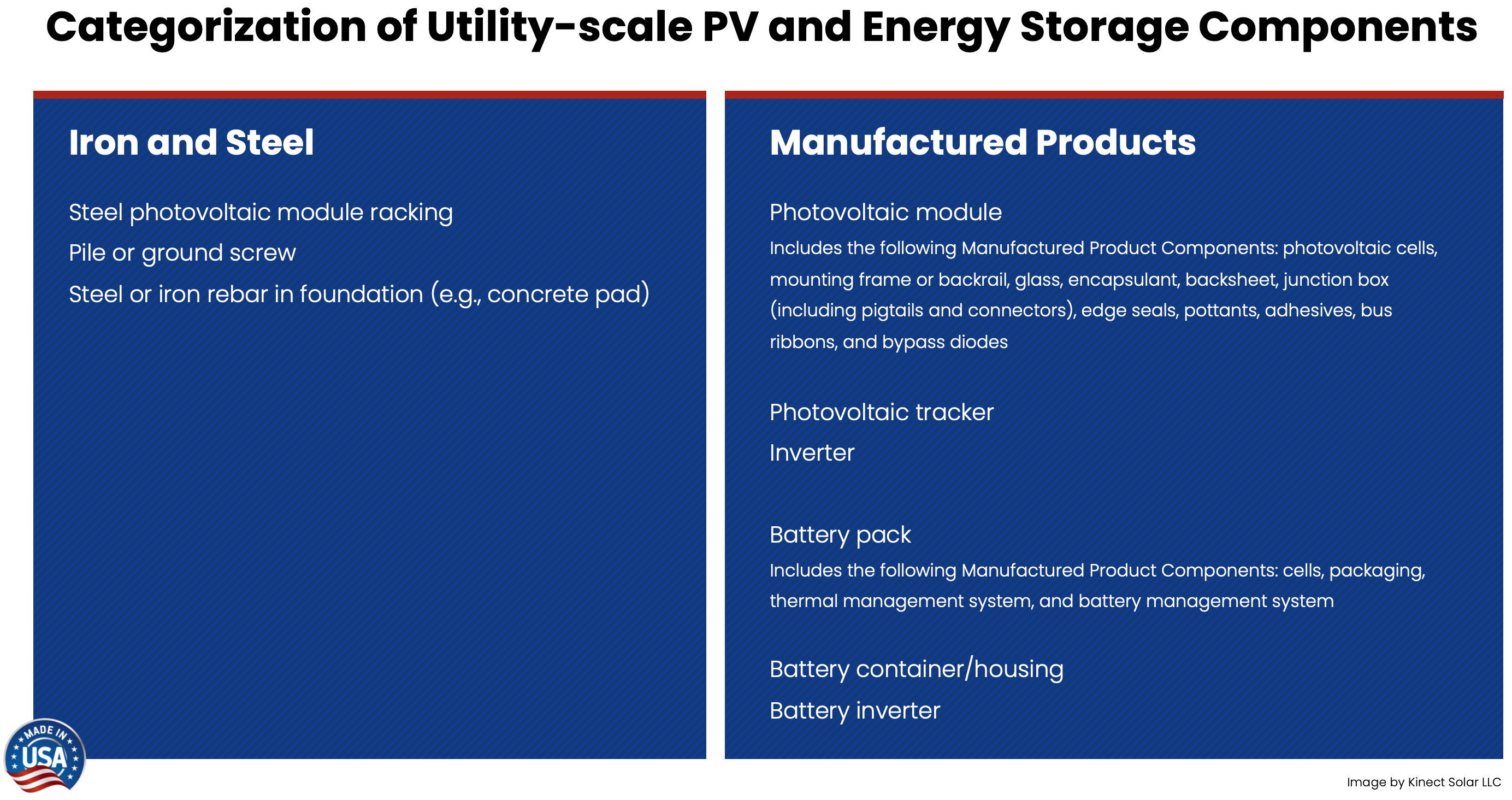

In a typical solar project, the total manufactured product cost will include modules, trackers, and inverters. The graphic below shows which components of a typical solar project are considered “manufactured parts” and which are in the “steel or iron” category, which must be 100 percent US-manufactured for the project to qualify. Labor costs are not considered.

As a developer, you will need to know the cost and manufacturing breakdown of every manufactured product: which components were manufactured in the US and which ones were not. For example, if a “US-made” product has three components, you need to know whether one, two, or all three of those components were actually manufactured in the US. If only one of the components meets the domestic manufacturing requirements, only one-third the cost of that product counts toward domestic content.

Developers will need manufacturers to certify the origin of components used to make “manufactured products,” show direct costs broken down by parts and materials, and accept liability if an IRS audit finds costs and breakdowns were not accurate. It remains to be seen whether manufacturers will willingly meet those conditions. We are already seeing that manufacturers who guarantee a higher percentage of US-manufactured products are charging a premium.

It’s important to note that the listed regulations are not final. Developers who start construction of projects by mid-August 2023 will have the option to apply these proposed calculations or to use whatever approach is adopted in the final regulations.

What if US-made solar parts aren’t available?

In cases where US-made components are simply not available, or where using US-made components would increase the cost of the project by more than 25 percent, waiver provisions are available. However, waivers can only be used to avoid a domestic content penalty, not to receive a bonus credit.

What’s still to be determined?

As mentioned, these guidelines are not yet final. The IRS is expected to release additional guidance in August. We’ll be looking for more details around a couple of points in particular:

- Balance of System (BOS) components are not referenced in the guidelines. These can make up more than 5 percent of the total cost of products used in a solar project and are often manufactured domestically. It will be important to know how or if they can be applied to the domestic content calculations.

- Extruded aluminum, which is commonly used in solar racking and mounting equipment, is also not mentioned in these guidelines.

How hard will it be to meet the Domestic Content Requirement?

Solar cells comprise approximately 30 percent of the cost of products in a solar project. Currently, there is no US supply of polysilicon-based cells and about 98 percent of wafers are manufactured in China. This means that in the short term, solar developers will need to rely on other equipment used in a solar project to meet the domestic manufacturing requirements.

Since the IRA was signed last year, a steady stream of solar manufacturers have broken ground or announced plans for US facilities. It typically takes about 18 months for a new facility to go from groundbreaking to production. The long-term vision for the solar industry shows domestic production rapidly expanding to meet demand, and a majority of solar projects using US-made products. Solar developers of the moment will be forging a new way to leverage supply chains and likely figuring things out as they go. Luckily, adapting to an ever-changing market is something solar installers and developers already excel in. Solar professionals also have a great resource in Kinect Solar. Our experts are committed to monitoring policy and manufacturing developments to help you navigate these changes for the better.

Sources and recommended further reading

Domestic Content Bonus Credit Guidance under Sections 45, 45Y, 48, and 48E [IRS]

Table 2 – Categorization of Applicable Project Components [Norton Rose Fulbright]

IRS details which renewable energy components must be made in the US to qualify for IRA tax credits [Utility Dive]

Treasury Dept. issues complex guidance for calculating U.S. module domestic content [Solar Builder Mag]

Treasury Department releases guidance on solar domestic content [PV Magazine]

US Treasury takes middle road on solar panels ‘Made in the USA’ [Reuters]

This post is provided for general informational purposes only and does not constitute legal or financial advice. Kinect Solar makes no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of this information. Kinect Solar is not liable or responsible for any damages or losses resulting from or related to your use of this information. This post includes links to websites not affiliated or endorsed by Kinect Solar.