At the end of each quarter, we like to highlight key developments and trends in the US solar market in our Solar Market Snapshot, with relevant links so you can explore more in-depth at your convenience and form your own opinions about the forces shaping this dynamic industry.

News that caught our attention in Q4 2023

Energy storage and utility sector break records

The US added a record-breaking 7,322 MWh of energy storage capacity in Q3, with another 4,450 GWh expected to come online in Q4.1 That total could have been considerably higher if 80% of projects hadn’t been delayed.2 This growth is being driven by a downward trend in the price of batteries3, strong demand, and policies like California’s NEM 3.0 that incentivizes storage attachments with solar.

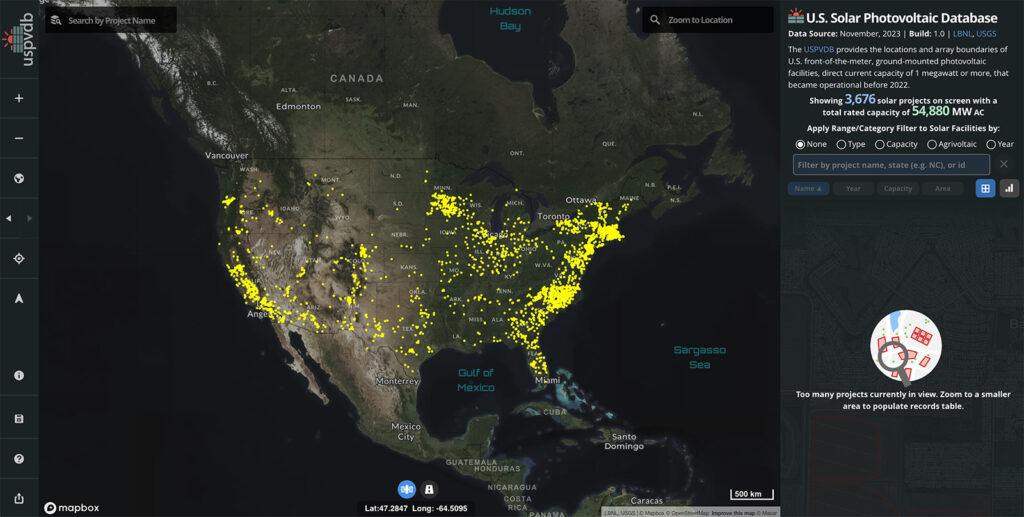

The utility sector had the strongest third quarter on record with 4 GW of new solar capacity additions.4 With its current trajectory of 150% year-over-year growth, the utility sector is likely to triple in the next six years.5 To keep up with all the new utility-scale solar power coming online, the US Department of Energy collaborated with other agencies to compile a map tracking solar-power plants larger than 1 MW (see callout below).

Learn more about the US Large-Scale Solar Photovoltaic Database

US Large-Scale Solar Photovoltaic Database (USPVDB)

The USPVDB provides the locations and array boundaries of U.S. ground-mounted photovoltaic (PV) facilities with capacity of 1 megawatt or more. It includes corresponding PV facility information, including panel type, site type, and initial year of operation. Click the image below to give it a spin.

Source: https://eerscmap.usgs.gov/uspvdb/

IRS clarifies portions of IRA

In the US, guidance and regulations for Inflation Reduction Act (IRA) policies continue to roll in, including new proposed rules for standalone storage6 and clean energy manufacturing credits.7 More clarifications are expected in 2024, especially around labor requirements.

Catch up on IRA-related news with these other blog posts from Kinect Solar

Related Blog Posts

Inflation Reduction Act of 2022: Exploring its Potential Impact on the Solar Industry | August 16, 2022

Inflation Reduction Act – Safe Harbor Updates | December 13, 2022

IRS Guidelines Issued for Domestic Content Requirements | May 22, 2023

Module prices drop due to oversupply

A global oversupply of solar modules continued to drive down prices 30-40% globally. That was good news for buyers but difficult news for manufacturers, especially with manufacturing costs triple what they were in 2021. As a result, some manufacturers were forced to reduce output or produce at a loss throughout the quarter. Some estimates show module prices dropping to $0.10/W by the end of 2024.8

Based on the manufacturing projects pipeline, [module supply] will expand to over 1,100 GW in 2024 and 1,300 GW in 2028, staying at more than double annual PV installations over the forecast period.

International Energy Agency Report9

Module price declines were less drastic in the US, falling only 15%. The US imported less than 0.1% of its modules from China in 2023 thanks to a combination of trade policies (UFLPA, AD/CVD, Section 201, and Section 301).10

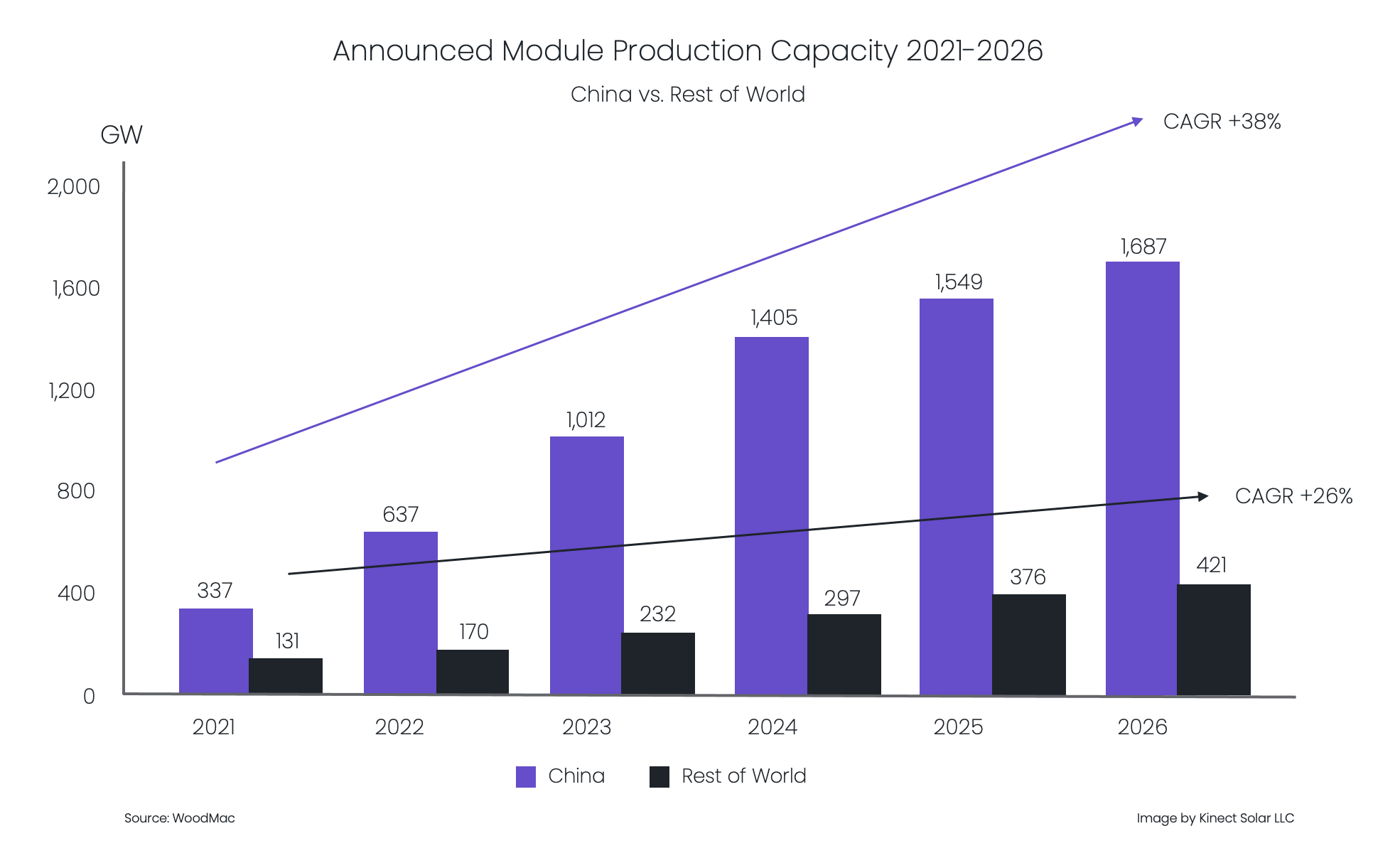

China dominates global module manufacturing

Wood Mackenzie estimates more than 80% of global solar manufacturing capacity through 2026 will come from China. In fact, there will be enough capacity from China by the end of 2024 to meet global forecasted demand through 2032. China has announced more than 1,000 GW of N-type cell capacity, “17 times more capacity than the rest of the world.”11

During the last half of 2023, China flooded the EU with modules, triggering calls for trade protections there and sounding the warning bell for other countries to be on the lookout for aggressive dumping practices. Without trade protections and domestic incentives in the EU (similar to the US’s Inflation Reduction Act or India’s Production Linked Incentive) to combat these aggressive dumping practices, European solar companies like Meyer Burger12 and Sinovoltaics13 are announcing they will move or expand operations into the US.

This one chart shows just how dominant China has become

China Dominance By the Numbers

In terms of module manufacturing capacity, China is absolutely dominating the rest of the world. If announcements made this year hold (which is unlikely given the current global price declines), China will more than triple all other manufacturers combined.

Source: WoodMac

Dive deeper into this topic with this independent report

Independent Report: Solar Exports From China Increase by a Third

For more on this topic, be sure to read this report from Ember, a solar think tank. This report details Chinese customs data on exports of solar modules in in the first half of 2023, pulling data from an open data set that is updated monthly.

Published: September 14, 2023

Lead Author: Sam Hawkins

Source: Ember

Auxin Solar petitions for removal of AD/CVD moratorium

Auxin Solar filed a complaint in December to remove the two-year moratorium on AD/CVD tariff collections. Much of the solar community disagrees with Auxin’s legal approach, arguing additional tariffs at this time would do more harm than good for domestic solar endeavors, but those winds may be shifting as more and more domestic production starts to come online. More to come on this as it develops.

Trouble in the Red Sea drives up shipping costs

The Israel-Gaza war has ignited additional conflict in the Middle East, and violence in the Red Sea has disrupted shipping routes. Carrier rates shot up dramatically after a Houthi attack on a Maersk container ship in the Red Sea led the company to abandon shipping activity in the region (there are other carriers still using the Red Sea route). Longer shipping routes and higher prices are expected to continue for the foreseeable future. Freightos Head of Research Judah Levine said new carrier rates and surcharges could result in Red Sea lane prices above $6,000 per FEU14, with volumes expected to shift to the West Coast.

Though the situation is still developing, Brian Whitlock, senior director and analyst at Gartner Supply Chain practice believes it’s unlikely disruptions will reach the pandemic levels of 2021.

In other shipping news, Maersk and Hapang Lloyd have announced a new partnership15 to begin next year after Maersk’s 2M alliance with MSC ends. Hapang Lloyd’s departure from THE Alliance raises questions about how the remaining members will adjust operations or partnerships to maintain competitiveness.

California market wanes under NEM 3.0

“As California goes, so goes the nation,” the old adage says. Let’s hope not. California’s NEM 3.0 policy is unraveling what was once the most robust solar market in the country. Late into Q4, California was on track to lose 22% of its solar jobs by the end of the year.16 Year-over-year solar sales in California fell by up to 85% after NEM 3.0 went into effect in April. The state’s public utilities commission also approved a highly criticized change to the state’s virtual net energy metering scheme for multi-meter properties like schools, apartments, and small businesses.

Analysts worry the changes will motivate Californians to go off-grid with energy storage17 rather than accept poor options from their utilities. Such a trend would negatively affect the state’s ability to meet fluctuating power needs as distributed solar and storage are becoming more and more important pieces of grid resilience plans. Either way, energy storage will continue to play an outsized role in California as consumers and project developers adapt to the new policies.

The government steps in to shore up supply chains and speed up interconnection

President Biden announced the Council on Supply Chain Resilience18, involving most of his cabinet and co-chaired by the National Security and National Economic Advisors; and the Department of Energy announced the easing of some environmental rules19 in an effort to speed interconnection throughout the nation. Transmission and interconnection continue to be key hurdles to deploying clean energy at the rates required to meet international climate change benchmarks.

Wind and solar projects continue to be bottlenecked by the shortage of high-voltage transformers, with lead times for the equipment now close to three years.20 Project owners have started to purchase transformers even before projects are approved, raising project risks dramatically. Developers have even begun turning to new methods of fast-tracking projects, including using software designed to identify areas with the best interconnection opportunities.21

TOPCon modules begin appearing in the US

Most industry experts agree that TOPCon modules are going to be the technology to beat in the not-too-distant future, largely due to their low degradation rates. Several manufacturers have announced plans to bring TOPCon to market in 2024. Canadian Solar has been bullish on TOPCon technology and recently announced the delivery of their first US-made TOPCon modules.22

Learn more about Canadian Solar’s TOPCon modules

TOPCon Modules from Canadian Solar

In December 2022, Canadian Solar announced that it would begin mass producing TOPCon modules. Those modules began rolling off the assembly line in June 2023 and can, as of this writing, be found in three varieties: TOPHiKu6, TOPBiHiKu6, and TOPBiHiKu7.

Source: Canadian Solar Website

Funding for renewable energy outpaces fossil fuels

Public and private funding continues to funnel into renewable energy. The Department of Energy created a $3.5 billion fund for battery manufacturing23, which will go toward building, retrofitting, or expanding domestic battery manufacturing and critical materials processing. The current administration also allocated $3.9 billion for grid support and modernization24 through the Grid Resilience and Innovation Partnerships program.

Clean energy projects now attract nearly two dollars for every dollar spent on fossil fuels. Five years ago, the ratio was one-to-one.

Canary Media

As noted at COP28, national policy and funding will need to rise to meet climate-related goals. We’re seeing US investment in clean energy attract additional commitments and investments from private and international entities, with clean energy projects now attracting nearly double the investments of fossil fuels.

Countries unite at COP28

At COP28, leaders of 118 countries pledged to triple renewable energy to at least 11TW25 by 2030 (with wind and solar accounting for 40% of electricity generation), but we echo concerns that without explicit commitments to strategies for reaching that goal, it could end up being more symbolic than practical. If utility-scale solar can continue at its current pace, the US may be well positioned to deliver on that promise. Ahead of the official conference opening, the US and China reached an agreement to cooperate26, solidifying hopes that the two largest economic powers would be willing to put aside their differences.

Kinect Solar is here to help

In this volatile solar market, the best thing you can do for your business is leverage a dependable partner. Kinect Solar specializes in navigating solar supply chain challenges. Lean on our expertise and connections to reliably manage your logistics and supply chain, keeping projects on track and on budget.

- US BATTERY STORAGE: Capacity surpasses 14.6 GW in Q3, 3.5 GW planned in Q4 | S&P Global ↩︎

- US installs record 7,322 MWh of storage in Q3 despite sweeping project delays | Utility Dive ↩︎

- Lithium-ion battery prices hit record low, drop 14% from 2022: BloombergNEF | Utility Dive ↩︎

- Solar Market Insight Report Q4 2023 | SEIA ↩︎

- Utility-scale solar on track to triple by 2030 | PV Tech ↩︎

- Treasury releases new proposed ITC rules on standalone storage, interconnection costs | Solar Power World ↩︎

- Section 45X Advanced Manufacturing Production Credit | US Department of the Treasury ↩︎

- Solar module prices may reach $0.10/W by end 2024 | PV Magazine ↩︎

- Solar modules are piling up in warehouses as a massive supply glut has slashed prices by half, IEA says | Business Insider ↩︎

- Solar Panel Prices Down 30–40% In 2023, US Prices Down 15% | CleanTechnica ↩︎

- China to hold over 80% of global solar manufacturing capacity from 2023-26 | WoodMac ↩︎

- European market distortion impacts 2023 financials | Meyer Burger ↩︎

- Sinovoltaics expands PV testing to US following IRA manufacturing boom and module price slump | PV Tech ↩︎

- Ocean freight rates surge further as Red Sea crisis develops | Supply Chain Dive ↩︎

- Maersk, Hapag-Lloyd to form operating partnership after 2M alliance ends | Supply Chain Dive ↩︎

- CALSSA: California could lose 17,000 solar jobs by end of 2023 due to NEM 3.0 | PV Tech ↩︎

- California rooftop solar policy struggles serve as warning to nation | PV Magazine ↩︎

- White House creates cabinet-level supply chain council | Supply Chain Dive ↩︎

- DOE wants to speed up transmission, solar, and storage projects by lightening environmental rules | Renewable Energy World ↩︎

- U.S. renewable, grid battery projects battle transformer shortage | Reuters ↩︎

- It’s hard to connect clean power to the grid. New software can help | Canary Media ↩︎

- Canadian Solar delivers first US-made TOPCon modules to distributor Signature Solar | PV Tech ↩︎

- Energy Department offers $3.5B for battery manufacturing | Utility Dive ↩︎

- Biden announces $3.9B for grid modernization as climate report warns of ‘insufficient’ adaptation | Utility Dive ↩︎

- COP28: 118 countries sign pledge to treble renewables by 2030 to 11TW | PV Tech ↩︎

- What A China-US Deal Means for COP28 | NY Times ↩︎

This post is provided for informational purposes only and does not constitute legal or financial advice. Kinect Solar makes no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of this information. Kinect Solar is not liable or responsible for any damages or losses resulting from or related to your use of this information. This post includes links to websites not affiliated with or endorsed by Kinect Solar.