Update: Clean Energy Credits and Domestic Content in the Wake of OBBBA

A lot has changed since the Inflation Reduction Act passed and the IRS issued initial guidelines for the Domestic Content bonus. Solar developers need to be aware of additional domestic content guidance and, especially, how the One Big Beautiful Bill Act (OBBBA) has changed Clean Energy Credits. Catch up on the new rules below.

New, Narrow Window to Qualify for Solar Incentives

The One Big Beautiful Bill Act (OBBBA) significantly curtailed the eligibility timeline for Clean Energy tax credits.

Tax benefits associated with sections 48E and 45Y (Clean Energy Credits, formerly the Investment Tax Credit and Production Tax Credit) were originally set to extend through 2032. Under the OBBBA, however, solar projects must now meet the following deadlines to qualify for a tax credit:

- Begin construction before July 4, 2026 OR

- Be placed in service before December 31, 2027

Additionally, projects that begin construction after December 31, 2025 must not violate newly stipulated FEOC restrictions (more on that below).

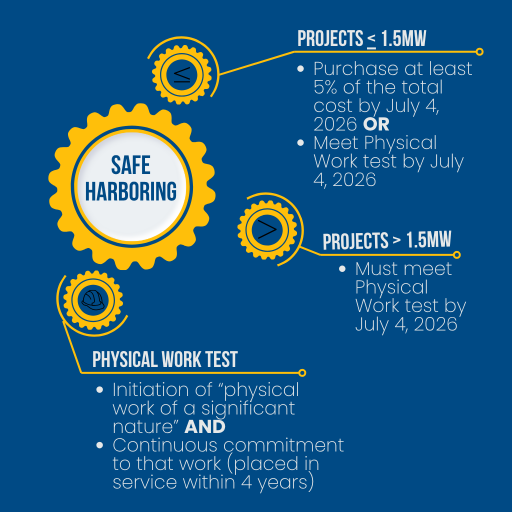

New guidance also restricted how projects can establish Beginning of Construction.

New IRS guidance eliminated the longstanding five percent rule for projects larger than 1.5MW, as of September 2, 2025.

The five percent rule allowed projects to establish Beginning of Construction by paying five percent or more of the total cost of the solar energy property by the safe harbor date. Solar developers often met this benchmark by buying equipment. (Projects 1.5MW or smaller can still use this benchmark.)

Projects larger than 1.5MW must now meet the physical work test to establish a Beginning date. This test requires the initiation of “physical work of a significant nature” and a continuous commitment to it.

- Physical work may include manufacturing custom-designed equipment for the project

- Physical work does NOT include:

- Preliminary activities like obtaining permits or securing funding

- Manufacturing components that are already in inventory or are normally held in inventory by a vendor

- Work involving assets already held in inventory

Projects meet the “continuous commitment” requirements if they are placed in service by the end of a calendar year that is four years or less after the start of construction. If a project is placed in service after four years, owners must somehow demonstrate continuous work. Excusable disruptions may include weather events, natural disasters, and permitting delays (see pages 9-10 of the IRS notice for a complete list).

New Restrictions on FEOCs

OBBBA changes to Clean Energy Tax Credits include restrictions to projects that involve Foreign Entities of Concern.

To maintain eligibility for the tax credits, solar projects must not receive material assistance from Specified Foreign Entities after December 31, 2025, AND taxpayers must not be specified Foreign Entities or Foreign Influenced Entities. Projects owned or funded by companies that are based in FEOC-designated countries will be affected.

FEOC compliance is likely to be complicated for the solar industry, which still relies on components from affected countries like China. Prohibited foreign entities include those with ties to China, Russia, North Korea or Iran.

Guidance on “material assistance” and other FEOC specifics has not yet been issued. Additional guidance is expected before the end of 2025.

Updated Safe Harbor Tables for Domestic Content

Before the OBBBA was passed, the IRS issued optional Safe Harbor tables to simplify requirements for the Domestic Content bonus credit.

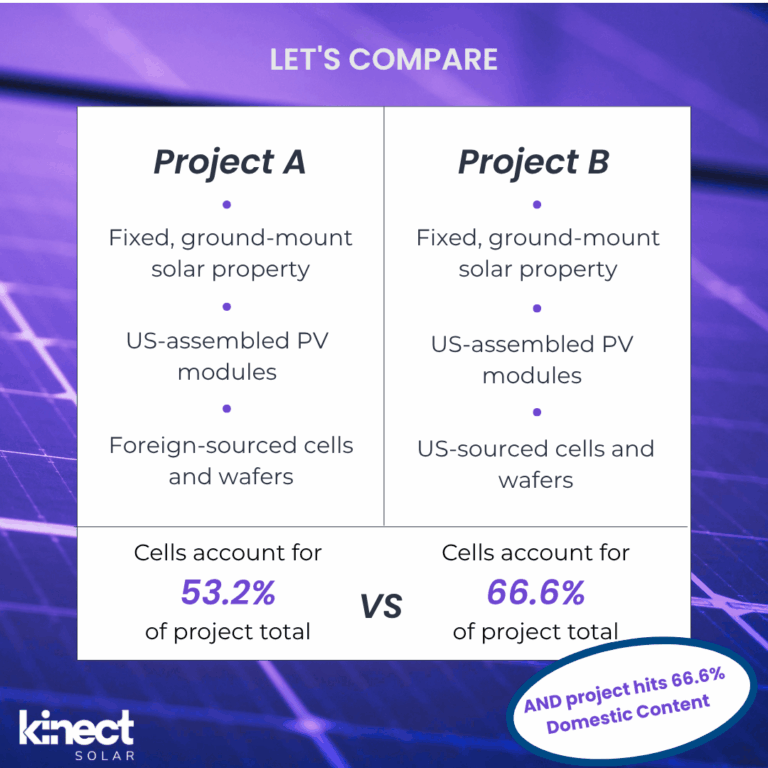

Though the timeline has been diminished, the existing guidelines to qualify for the bonus credit still apply. The elective Safe Harbor Tables are intended to remove the complication of cataloging the exact cost of every single component. Developers can use the percentages in the tables to quickly calculate how much of their equipment was domestically made.

The most updated Safe Harbor tables award higher percentages to domestically manufactured cells and wafers, making it easier for projects using those components to qualify for the domestic content bonus.

We stock several First Solar product lines in our warehouses, including new and legacy solar panels that qualify as 100 percent domestically made. As an authorized First Solar dealer, we also have access to additional inventory from First Solar, with exclusive pricing for Kinect Solar buyers.

Solar Developers Can Still Qualify for Clean Energy and Domestic Content Tax Credits

But the clock is ticking.

As shown in the Safe Harbor tables, solar cells account for anywhere from 31 to 66 percent of a solar project’s equipment. Though the capacity of US solar panel production has quintupled since the IRA was signed and there is now enough domestic PV manufacturing to meet US demand, there are still gaps in the supply chain. Specifically, crystalline silicon and metal frames are still heavily dependent on imports.

Even with the persisting supply constraints, we are seeing clients hit the minimum requirements to claim the Domestic Content bonus credit. The updated Safe Harbor tables, giving additional weight to US-made panels, brings the threshold even more within reach. Careful equipment sourcing is the key, alongside aggressive timelines to meet new deadlines.

Posted in:

DISCLAIMER: This post is provided for informational purposes only and does not constitute legal or financial advice. Kinect Solar makes no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of this information. Kinect Solar is not liable or responsible for any damages or losses resulting from or related to your use of this information. This post includes links to websites not affiliated with or endorsed by Kinect Solar.