At the end of each quarter, we like to highlight key developments and trends in the US solar market in our Solar Market Snapshot, with relevant links so you can explore more in-depth at your convenience and form your own opinions about the forces shaping this dynamic industry.

Jump to Section

Residential market oversupply

PPA price increases

UFLPA detentions

AD/CVD determination

Permitting, transmission, and interconnection bottlenecks

Port volumes

Labor shortages

IRA requirements

Post-IRA momentum

Trends to watch

Residential market oversupply

And down goes the solar coaster

Historically, the residential market has proven to be stubbornly resilient to policy shifts, trade battles, supply chain challenges, and even the COVID-19 pandemic. But high interest rates and inflation are hitting the market where it hurts most – consumer demand.

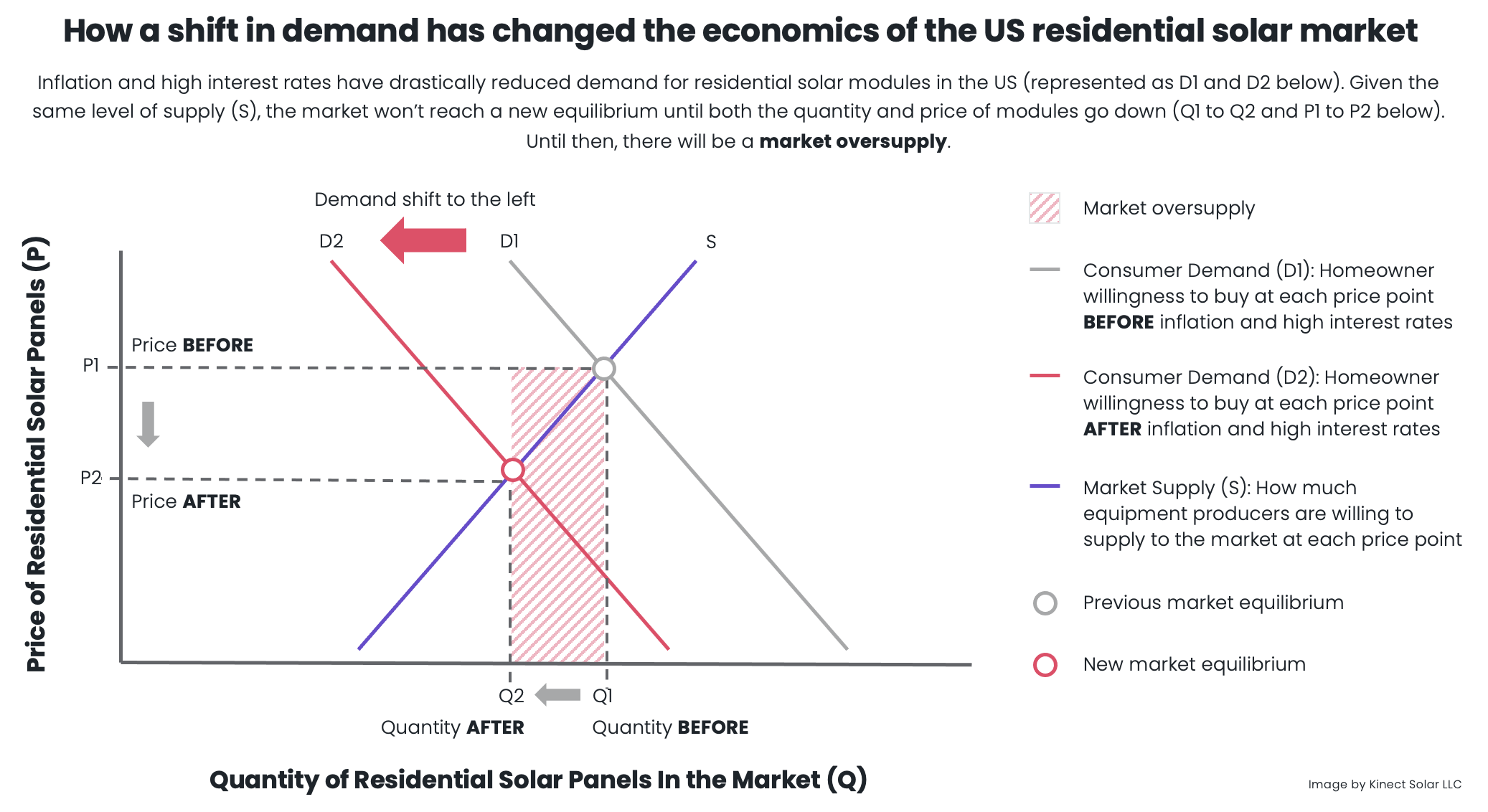

High inflation is forcing most consumers to reevaluate their spending choices and cut back on non-essentials (like installing solar energy). At the same time, high interest rates are driving up solar installation costs and making solar loans less affordable. As a result, consumer demand for residential solar has dropped significantly, leaving the market in an oversupply situation.

When there is a surplus in the market, manufacturers cut back production and distributors drop prices. This is exactly what happened in the third quarter. Many manufacturers lowered their production forecasts and distributors offered deep discounts. Anyone sitting on excess or stranded residential modules rushed them to the market, hoping to sell before prices hit bottom.

Here are a few other challenges impacting the residential sector in the third quarter:

- Credit lenders and financing institutions are tightening their requirements. As a result, small and medium-size residential installers are finding it harder to access capital. And for the larger residential installers, securing tax equity is even more onerous.

- Supply chain shortages are still impacting several inverter, battery, and component manufacturers, resulting in longer lead times and higher overall system costs.

- As predicted, NEM 3.0 had a big impact on demand in California, where install rates dropped 35 percent year-over-year in the third quarter.

When you add it all together, it’s been a difficult quarter for the residential market, and it’s unclear when the market will reach bottom. Ohm Analytics is predicting a 10 percent year-over-year decline in residential installations in 2024.

Taking advantage of this downturn

Residential module prices dipped below many commercial module prices – something we haven’t seen in a long time. Consider buying residential modules now and storing them for your Q1 2024 projects. The solar coaster won’t stay down forever.

The Kinect Solar Sales team has helped several C&I installers redesign their small C&I projects to incorporate lower power class modules. These smaller form factors are easier to install and offer additional benefits as well.

PPA price increases

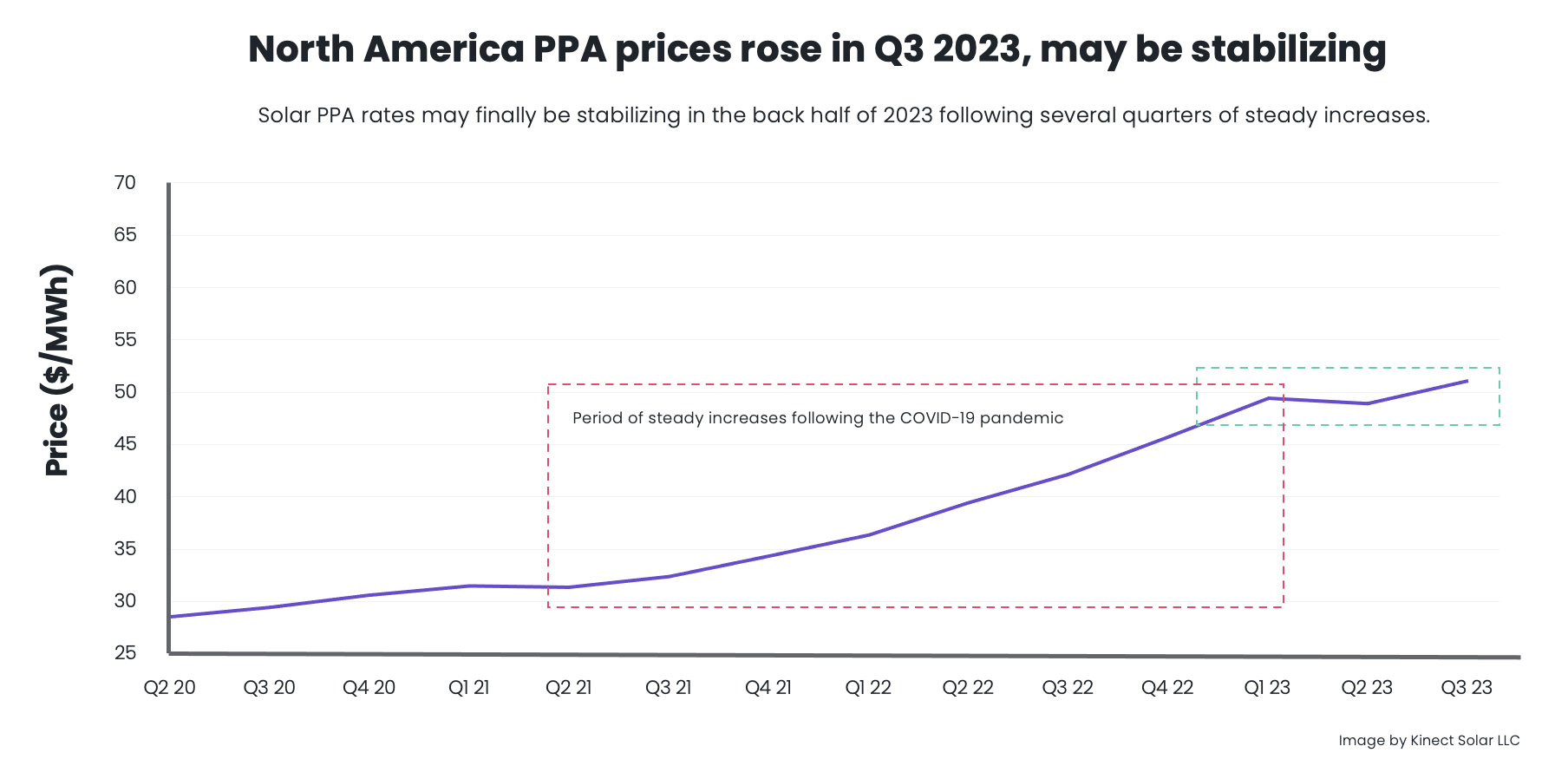

High inflation and interest rates aren’t just affecting the residential sector. Average PPA prices rose 4 percent in the third quarter, pushing past $50 per MWh, according to LevelTen Energy. Developers are wrestling with high construction costs, longer timelines for securing bids, and congested interconnection queues. These costs are being passed along to corporate buyers, who are increasingly looking to other sources, like virtual PPAs and tax equity transfers, to meet their sustainability goals.

The good news is that industry experts seem to think PPA prices have leveled off after steady increases over the past several quarters and that IRA incentives will spur project development which may eventually soften PPA prices, though likely not to pre-pandemic levels.

Source: Environment+Energy Leader

UFLPA detentions

During the third quarter, the Customs and Border Protection (CBP) increased detentions of solar modules from China and Southeast Asia as authorized by the Uyguhr Forced Labor Protection Act (UFLPA).

Unlike the AD/CVD guidelines, which are relatively well defined, the UFLPA is much less transparent. The CBP is free to seize any modules it suspects may have ties to the Xinjiang region of China, and because importers bear the burden of providing supply chain documentation, manufacturers aren’t able to easily bypass the process.

Module supply has been difficult to predict as a result, especially in the utility-scale sector, which depends on large volumes of modules arriving on schedule. South Korea, India, and other countries are rushing to fill the gap, but redesigning projects already underway is a costly disruption.

We believe these UFLPA detentions may have a significant impact on module supply in Q4 2023 and beyond. You can read our take on these developments in this blog post.

In related news, China dumped 85GW of Chinese modules in the European market below manufacturer costs, creating a crisis for domestic manufacturers. Tariffs and UFLPA detentions have largely shielded the US from these dumping practices, leading several European manufacturers to call for similar protections.

AD/CVD determination

On August 18, the US Department of Commerce issued its long-awaited decision in the Auxin Solar AD/CVD case, with a determination that five of the companies investigated were circumventing US antidumping and countervailing tariffs: BYD Hong Kong, New East Solar, Canadian Solar, Trina Solar, and Vina Solar.

The Department of Commerce also extended AD/CVD tariffs to exports from Cambodia, Malaysia, Thailand, and Vietnam that include silicon cells made with Chinese wafers and silicon solar panels made with Chinese wafers that include at least three Chinese-made materials (silver paste, aluminum frames, glass, backsheets, EVA sheets, or junction boxes). The latter of these is known as the “wafer-plus-three” guideline.

Because of the Biden administration’s 24-month moratorium on AD/CVD duties, none of these companies will be immediately subject to tariffs, and it’s likely they will apply again for “not circumventing” status before the moratorium expires on June 6, 2024.

Source: Solar Power World

SEIA disagreed with the investigation’s determination, decrying it as a barrier to solar implementation in the US. SEIA has repeatedly said it will take three to five years for domestic manufacturing to ramp up to meet the demand spurred by the IRA. President and CEO Abigail Ross Hopper said, “This case will just make it harder for American businesses to keep deploying, financing, and installing solar power.” Extending the tariff moratorium is one suggestion to allow US companies more time to get manufacturing facilities in place, something the Biden administration has previously said it does not plan to do.

Permitting, transmission, and interconnection bottlenecks

Anyone who has worked on a commercial-scale solar project knows the lengthy permitting timeline is a key barrier to solar implementation. This summer, the Biden administration’s Council on Environmental Quality released a proposed permitting reform rule that would streamline the permitting and environmental reviews for solar and transmission projects on federal land. SEIA said the proposed rule would speed timelines for solar projects. The bipartisan proposal has faced some pushback in Congress. The Department of Energy also launched a $10 million program to offer funding and technical assistance for planning, siting, and permitting of large-scale renewable energy projects on private land.

The US is falling increasingly behind China and Europe on interregional transmission, despite bipartisan calls for better domestic energy security. In an effort to boost implementation, the US Department of Energy announced $300 million aimed at standardizing and streamlining the transmission siting and permitting processes.

The Federal Energy Regulatory Commission released a long-awaited interconnection ruling with firm deadlines to speed interconnection queue processing. SEIA agreed the ruling is a good first step in much-needed interconnection reform and hailed FERC’s decision to scrap its previously proposed commercial readiness rule which would have been a major barrier for clean energy developers. Unfortunately, while other experts agree it’s a good first step, there is little evidence the ruling will have much effect in speeding things up, as many regions already follow the standards set by the ruling.

Port volumes

Predictions for freight going into 2024 suggest rates are likely to remain low there as well, another potential cost advantage for developers in spite of the uncertainty around potential labor strikes we saw last quarter. A resolution to the dispute between International Longshore and Warehouse Union and the Pacific Maritime Association was finalized when the two parties ratified a six-year contract; an increase in port volumes has since been reported for the first time in more than a year.

Labor shortages

Amidst the country’s massive response to the IRA (more on that below), alarm bells are ringing over the lack of qualified workers available to implement record-breaking clean energy project plans. Though this is certainly a challenge that will need to be addressed, it’s our favorite kind of challenge: figuring out how to get people into great jobs while installing more solar. The White House has responded by starting the American Climate Corps to put people to work in clean energy jobs. Many of the jobs require little to no previous experience.

The solar industry is also already seeing an influx of 18-to-29-year-olds: they made up nearly one-third of the solar workforce in 2022. We’re excited to see how this demographic continues to show up in the solar sector and propel the clean energy revolution forward in the US.

IRA requirements clarified

In other policy news, the Treasury Department issued new preliminary guidance on the IRA, including requirements for the 10% domestic content bonus credit.

Apprenticeship and prevailing wage requirements: To qualify for IRA incentives, laborers or mechanics on a project must be paid no less than the prevailing rates determined by the Department of Labor. The guidelines include a good-faith exception for companies that have tried to hire apprentices but are unable to do so, as well as provisions for companies that have erroneously not paid a prevailing wage to correct the error within 30 days without penalty.

Elective pay and transferability: Tax-exempt and government entities may receive up to 12 payments for renewables projects under the ITC or PTC. This allows state and local governments, as well as large nonprofits, greater access to renewable energy deployment.

Post-IRA momentum

The fire lit under the solar industry by the IRA last year is still burning brightly. New domestic manufacturing announcements continue to roll in and solar installations are outpacing forecasts. The US is on pace to add a record 32GW of new capacity in 2023. As hoped, the IRA is also prompting increased private investment in solar. More than 200 major new clean energy projects have been announced, driving up to $86.3 billion in private investment. Solar and storage jobs are expected to grow to nearly 500,000 in the next decade.

The energy in the current solar movement may be most palpable in gatherings of solar professionals. It’s a thrilling time to work in clean energy, as we saw at the annual RE+ conference. Attendance rocketed from 27,000 attendees in 2022 to more than 40,000 this September. Infrastructure and supply chain challenges abound, but this workforce is energized and we love being part of the innovative solutions that continue to advance solar, regardless of policy and market challenges.

Trends to watch

Consolidation in the market

Painfully high inflation and interest rates are going to force a lot of companies to make some hard decisions over the next few months. Residential and small C&I will be the hardest hit, but everyone will be impacted in one way or another. We’ll be watching for M&A and bankruptcy announcements over the coming months.

Third-party ownership on the rise

We’ve talked in detail about the rise of Third-party Ownership in the current solar market. TPO rose from its 2022 low to 25 percent market share in Q2, with some markets seeing much bigger increases (New Jersey’s TPO share grew to nearly 70 percent and Massachusetts to nearly 60 percent but California’s rush of NEM 2.0 projects brought the overall market number down). Median APRs rose to 4.49 percent in the first half of 2023, negatively affecting the return on a residential solar investment and making TPO options more appealing than traditional solar loans. As APRs rise, of course, so do dealer fees.

NEM 3.0 slows demand for solar but increases battery attachment rates

The NEM 2.0 backlog is expected to extend through the end of 2023, but projections show a 35 percent year-over-year PV market drawdown in California as solar businesses figure out NEM 3.0 sales strategies. As California moves into that 3.0 phase, energy storage adoption is expected to grow.

Energy storage expected to grow year over year

Federal funding for solar plus storage in Puerto Rico ($450 million) combined with California’s NEM 3.0 are predicted to drive 98 percent year-over-year residential storage growth in 2024. We are observing almost all major solar manufacturers getting into batteries in advance of the apparently assured surge in battery adoption.

Chinese dominance in module manufacturing

China is investing significantly more than any other country in module manufacturing and is on track to double its 2022 total module manufacturing capacity by the end of this year. With government subsidies and low labor costs at their back, it will be nearly impossible for other countries to compete on a price basis with China. All of this capacity will drive down prices and create the perfect environment for continued dumping. As a result, we expect to see more countries embrace anti-dumping protections in the coming years. We also expect the pace of new US module manufacturing expansion to slow significantly.

How we can help

Our Solar Professionals specialize in helping you make the most of the current market conditions, no matter what they are. In today’s environment, our clients are finding particular advantages by coming to us to source equipment at amazingly low prices, get rid of stranded or excess inventory, and secure transportation or warehousing for upcoming projects. Get in touch and let’s see what we can do to help your situation.

Sources and further reading:

A Caldera in Nevada Now Has the Most Lithium in the World. Let the Gold Rush Begin. [Popular Mechanic]

Are distributed renewable energy projects the answer to interconnection woes? [Renewable Energy World]

Commerce Department’s Solar Tariff Decision Imperils Clean Energy Boom [SEIA]

Can we finally win a victory for U.S.-made solar modules? [Renewable Energy World]

China’s EU dumping makes subsidy-rich US a no-brainer for growth, says renewables player [Recharge News]

DOE launches $10M program to speed up large-scale renewables permitting [Renewable Energy World]

Duke, AEP, Exelon among those primed to benefit from transmission investment: Moody’s [Utility Dive]

Fact Sheet | Improvements to Generator Interconnection Procedures and Agreements [FERC]

FERC interconnection rule may not speed process in much of US: experts [Utility Dive]

Interregional transmission: The US is the tortoise, China is the hare [Utility Dive]

IRA drives $12.4B into US storage as investments ‘juice’ an already strong market: Freyr exec [Utility Dive]

Key Republican casts doubt on bipartisan permitting deal over dispute with White House [The Hill]

LevelTen Energy Reports Elevated Wind, Solar PPA Prices [Environment+Energy Leader]

Lithium Deposit In Extinct Nevada Volcano Could Be Largest In The World [Clean Technica]

Port of Los Angeles sees the first volume increase in 13 months [Supply Chain Dive]

Renewable PPA dealmaking slows as high solar prices appear set to stay: LevelTen [Utility Dive]

Residential solar is getting crushed by high interest rates and regulatory changes [PV Magazine]

Solar and Storage Industry Reacts to Final Interconnection Rule [SEIA]

Solar Installations in 2023 Expected to Exceed 30 GW for the First Time in History [SEIA]

Solar PPAs and Leases May Outpace Solar Loans this Year [Kinect Solar]

Uptick in UFLPA Module Detentions Could Impact Module Supply in Q4 2023 and Beyond [Kinect Solar]

US solar industry split on potential impacts of AD/CVD ruling [PV Tech]

US Treasury releases IRA guidance to widen net of tax credit recipients [PV Tech]

US Treasury unveils wage, apprenticeship guidance for clean energy tax credits [Reuters]

White House launches clean energy youth workforce program amid labor shortage concerns [Utility Dive]

Young workers are flocking to renewable jobs, but the sector remains short on labor, reports show [Utility Dive]

This post is provided for informational purposes only and does not constitute legal or financial advice. Kinect Solar makes no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of this information. Kinect Solar is not liable or responsible for any damages or losses resulting from or related to your use of this information. This post includes links to websites not affiliated with or endorsed by Kinect Solar.